How Digital Banking with Low-Code Enhances Customer Experience

Compliance and customer service might seem at odds with each other—especially when it comes to digital banking. But in this post, we share effective strategies and tips on digital banking customer experience including low-code banking process automation. Learn about the banks that have achieved great success in customer experience with actionable takeaways.

Innovating digital banking and customer experience

Oil and water. That’s often the visual that comes to mind with most IT departments when thinking about innovating customer experience and compliance. The two concepts go together like oil and water.

ABN AMRO and Rabobank, two European banks, had very different needs when they began using Mendix. Their goals, however, were similar:

- ABN set out to make “banking better, for generations to come,” by creating a future-proof architecture.

- Rabobank embarked on a journey to provide better services for their customers in Germany and Belgium, and ensure that they are building toward a better future as well.

Both banks used low-code development to address regulations while focusing on their customer experiences, thereby setting themselves and their customers up for success for years to come.

How 2 banks transformed their customer experiences

In the Netherlands, Rabobank is a big retail bank. However, in the rest of Europe, Rabobank is a niche player, focusing on food and agriculture financing.

International Direct Banking (IDB) operates online savings products for 500,000 customers across Belgium and Germany. IDB only offers savings products. That money is then transferred to the Central Treasury department, which transfers the money over to another department that provides loans and mortgages, mainly to farmers.

Rabobank’s online banking channel was part of its core banking system, through which customers managed their savings. The online banking experience was, as IDB IT Architect Joost Landman said, “below average.” It needed an update.

Poor customer experience often leads to churn, and to combat this, Rabobank offered better interest rates to entice customers to stay. This became a problem when the Central Treasury began to complain about the cost of transferring the savings money to loans.

Updating this system was difficult because of two things. One, their IT landscape was very disparate, with a unique instance of IT for each location. Two, regulations took priority when it came to updating applications and systems. Because of logistics or compliance, customer experience always took a back seat for IDB.

Landman needed to figure out how the IDB could make private savings a good source of funding for the Treasury. He knew that a change needed to be made.

Are you in control of IT?

ABN AMRO found themselves in a similar situation. Recently, they set out to reinvent the customer experience. With sustainability a large focus for both themselves and their customers, ABN wanted to build a bank that was fit and ready for the future and supported their clients’ transition to sustainability.

To do this, they needed to rethink their application portfolio strategy. Upon evaluating their portfolio, Pascal Smissaert, IT Engineering Lead, was asked the question by ABN leadership, “Are you in control of IT?”

ABN had 400+ end-user apps developed in Access, Excel, SharePoint, and other tools. They had 200+ employee-facing apps developed in Domino and Lotus Notes. They were primarily a Mode 1 IT department without room for experimentation or customer focus.

With pervasive shadow IT and a brittle legacy portfolio of 600 applications, Smissaert’s answer to the leadership’s question was an honest “No.” He set out to make changes.

Investing in the future

Both banks desired to be faster, more flexible, more in control, and to better respond to customer needs. Regulations around data security and privacy made it difficult for ABN AMRO to change and innovate.

Smissaert established a future state for his architecture: to aggregate existing services and data, focus on presentation and experience, reduce time-to-market, plan for the experimental project and move toward a faster, more flexible development process.

His goal was to begin creating cloud-native applications that would tick off all the boxes he desired for his architecture.

For Landman, his main directives were farm financing and savings. Those were his customers’ primary needs. To serve those customers, Rabobank IDB needed to focus on three things:

- Focus on the savings product only

- Reduce costs by 50% or more

- Improve the customer experience so that they wouldn’t have to increase interest rates

The bottom line for Rabobank’s initiative wasn’t simply one for their business. A better customer experience meant that, on top of their already competitive interest rates, customers would be more enticed to stay with Rabobank. That meant that they could use the savings revenue to provide loans to farmers.

Interest in low-code

Rabobank left no system untouched. Landman rebuilt their core banking system, so instead of seven instances across multiple countries, it was one.

Formerly hosting their data center on-premises, they migrated to the cloud. They shifted to a two-speed IT department, giving themselves the ability to focus on both systems of record and systems of differentiation.

With the latter, they desired to keep the development of those applications close rather than outsourced. Because they were mainly a project-management focus IT shop, the notion of developing apps themselves was a daunting one.

With the Mendix low-code platform, Landman was able to turn his on-site IT team into a classic IT shop floor and build a new internet channel, all without having to hire any Java developers. To build their online presence, they mixed their web content management system with the user interface from a Mendix-built application at the HTML level. This was important because they did it all without custom code.

“We were able to build functionality and release it in a fast cycle…to do it with a relatively small team with mostly—and this is important to me—business-oriented developers rather than code-oriented developers,” Landman said. “This would enable us to get really good cooperation with the business people, the product owner, and the end user. That’s why we liked that idea so much.”

They did it all without custom code

The idea of eliminating custom code was a great relief to Landman.

In theory, the risk that something is wrong in the code and ending up with security incidents is much lower when the code is automatically generated and technically sound.

Being a bank with large volumes of payment transactions, there’s always a great security risk. And that was evident, too, when Rabobank moved to the cloud. The apps they built are not hosted in the Mendix Cloud, yet they chose Azure DevOps.

Smissaert also opted for Azure DevOps as ABN’s public cloud. His team became the first in ABN to move to the public cloud. This was no small task, as it’s difficult to be as experimental as Smissaert was in an industry constricted by regulations surrounding data protection and privacy.

With over 600 apps to update, maintain, or rebuild, Smissaert wanted to put the power of developing into the hands of the business, to “enable others to create value for our customers,” he said.

To properly do this, Smissaert positioned a Mendix Platform team. This team consists of eight IT developers and one product owner. They all use the Platform to handle the application lifecycle of their portfolio, set up standards and guidelines around developing and deploying applications, and offer consultancy and user support to business developers.

Value you can take to the bank

Moving development away from tools like Access and Excel and using one platform is a huge leap forward for ABN AMRO. With Mendix, Smissaert is taking back control of IT and building a more sustainable architecture that supports both ABN and its customer base.

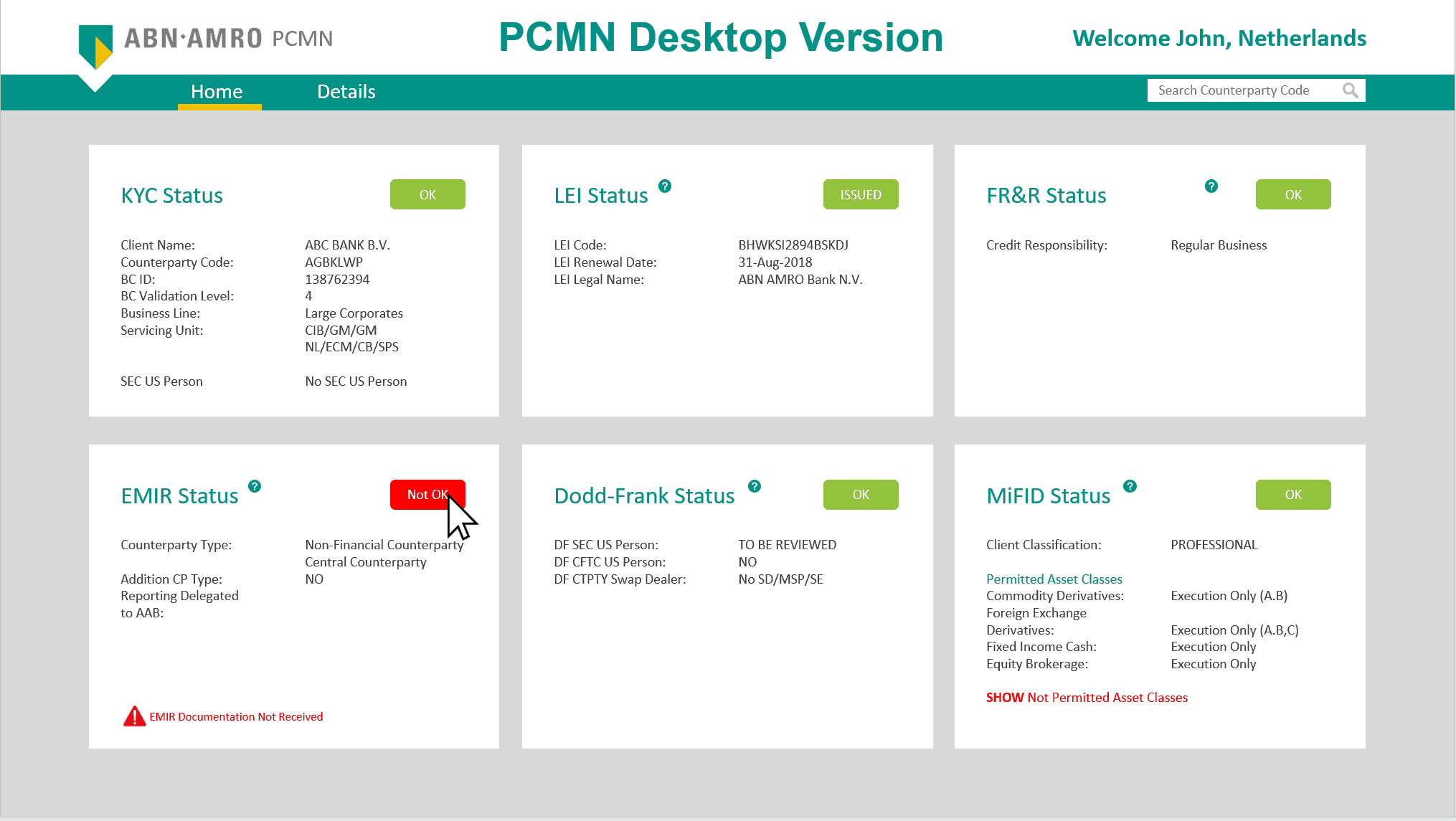

ABN is achieving both control and speed. One product ABN has built with Mendix is the mobile version of the Pre Trade Counterparty Manager (PCMN) tool. This is a procedural regulatory pre-trade check application that, based on color coding and business logic, lets users quickly review and approve trades that clients have requested.

PCMN collects clients’ information from a number of source systems and needs to move fast. There was a desktop version already in use, but that didn’t work for users who were on the road, away from their desktops.

Within four hours at an ABN AMRO-sponsored hackathon, a team was able to create a production-ready mobile version of PCMN. With this new application, ABN’s clients are getting faster responses to their trade requests and business is moving faster.

Similarly, Rabobank has re-created the way customers interact with their product in a short timeframe. In just a few months, over 500,000 Rabobank customers were on RaboDirect, an internet banking portal that manages over €18 billion in money. What’s more, they were able to cut 50% of the costs, realized in systems of record and infrastructure.

Currently, Rabobank has five applications running in production. The business-oriented developers have moved to weekly sprints to release to production. This is a great leap from where they were just months before.

The mindset at the bank needed to be more agile-focused. Landman easily spun up his development team, but the infrastructure was slow to follow. There were too many waterfall elements. They were able to make changes with the power of low-code.

Landman remarked about the biggest change Mendix had on his team: “The most important change that Mendix brought about in our department was a difference in energy.” Using and partnering with Mendix showed Landman what digital transformation truly looks like in practice.

As such, Rabobank has selected Mendix as their standard low-code development platform. They’re not stopping at the online portal. They’re building proofs of concept that are showing the rest of the business that not only can Landman’s IT build new apps, but they’re having fun doing it. They’re currently working on:

- A native mobile banking app for their 500,000 customers.

- A demo app for the payment service directive, an app that publishes APIs that are consumed by third-party apps that initiate payment orders or account information for customers.

- A customer onboarding app that ensures compliance with data protection rights while maintaining a customer experience that users expect.

With Mendix, ABN AMRO and Rabobank are simultaneously remaining compliant but also innovating. Both are changing the way they build apps so that they can change the way their customers use their products.

Watch Rabobank explain their low-code journey

Key takeaways

- In a matter of months, Rabobank built a fully integrated, online banking portal that manages €18 billion for over 500,000 customers

- ABN AMRO on track to build >200 end-user apps in Mendix by end of 2019

- Rabobank reduced IT costs by 50%

- In just 4 hours, ABN AMRO created a mobile version of PCMN, a highly used, critical desktop application that facilitates trades

- Both banks moved to the public cloud, no small feat in a heavily regulated industry

- All accomplished with low-code.