Customers are demanding ever increasing levels of digital engagement and insurers need to find new ways to use technology to improve their services to entice new customers and retain existing ones. In our previous post, we shared how we applied a design thinking approach to build an engaging claims process, which focused on solving the key UX challenges to make the customer’s journey as seamless as possible. The claims app is just one of a suite of insurance solutions developed by the Mendix Evangelist team which has been designed to showcase how the Mendix Platform can be used to address four key drivers for digital transformation:

- Launching new products

- Improving customer engagement

- Improving operational efficiency

- Legacy migration

In addition to great UX, it is important to deliver applications that are flexible, scalable and have future-proof architecture.

Insurers are coming under increasing pressure from new insurtech startups, who utilize the latest technology to provide new products with differentiating experiences. Examples include:

- Lemonade, who provide home insurance and utilize video analytics to help reduce fraudulent claims.

- Neos, a home insurer that utilizes smart home equipment like security cameras, intrusion sensors, and leak sensors to proactively prevent incidents.

- Spixii, which provides intelligent chatbot functionality for the insurance market, helping customers understand the often difficult and confusing terms included in their insurance policy.

These insurtech startups build using the latest technology from the ground up, but for them to continue to be successful they need to make sure they have a scalable architecture to meet increasing demand.

When building our suite of insurance applications, there were two main focuses:

- To be engaging so that we could demonstrate the capabilities of the platform.

- Digital Insurer Transformation – How existing insurers could utilize our platform to become a Digital Insurer.

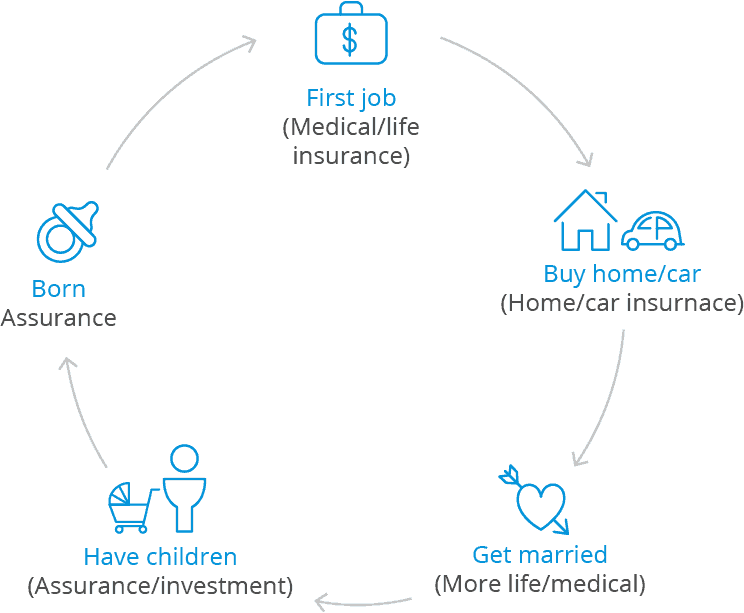

Digital Insurers of the future need to move to a holistic engagement model whereby they offer their customers better, more appropriate insurance products throughout their lifetime. To do so, they need to use technology to engage with customers better.

Better engagement means understanding the customer needs based on multiple factors and data points, such as age, demographics, and significant life events (e.g. marriage, buying that first home and having children). By continuously analyzing this information, insurers can begin to deliver tailored insurance products to meet specific customer needs at the most appropriate time. Carriers are well suited to deliver on this holistic approach and compete with insurtech startups who offer simple point solutions. But this can often come at a cost, so it is important to embrace technology to lower costs by improving operational efficiency.

So how did we go about architecting our insurance offerings?

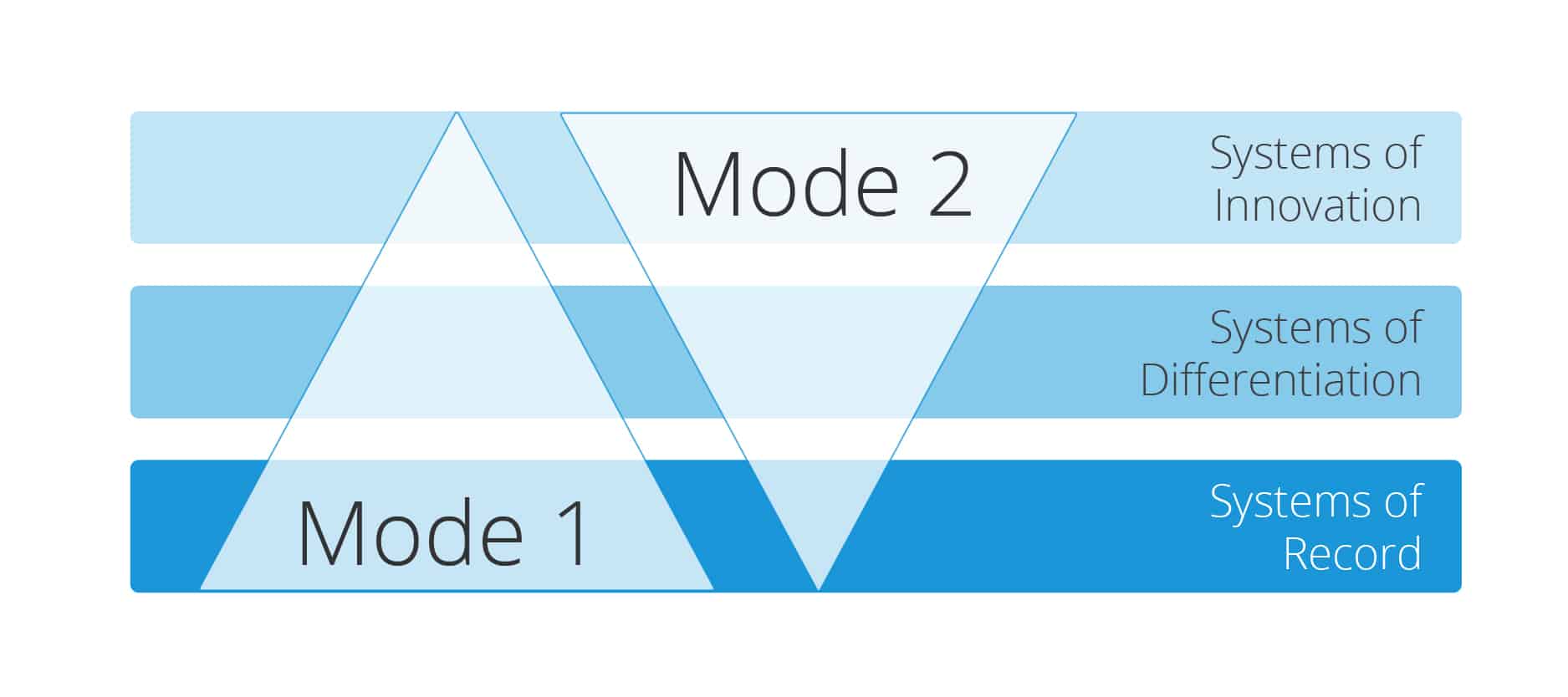

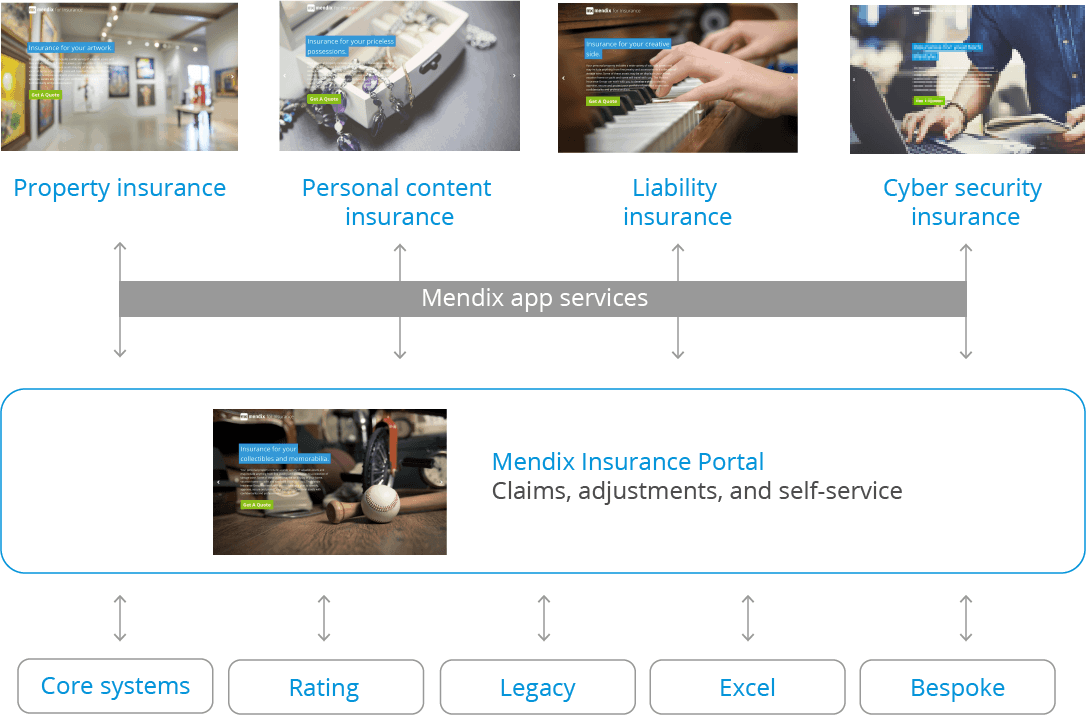

When starting to architect our project, we identified three types of applications we wanted to deliver based on market demand:

- A personal property coverage product

- A self-service claims portal

- An underwriting rating portal

These applications each represent a different stage of the insurance lifecycle and a different layer of the Gartner Pace Layer model.

How do our 3 applications share data?

Delivering an insurance product in the modern era requires an ecosystem of interconnected applications and scalability to deal with increasing demand over time. Therefore, it is essential to explore a microservices approach.

Microservice application development suggests that large applications should be built into a suite of modular services. Rather than one large monolithic application, it should be built from several small services, with each one supporting a specific business need. To develop this, we separated our applications into several core functions: Quoting, Policy Management, Rating, and Claims.

These core functions all utilize Mendix App Services to allow for cross communication and sharing of data. App Services allow you to easily share data and logic between applications without having to worry about web services, xml mappings, or schemas. The added benefit of these services is that they have built-in version control and dependency management. These services can then be published on the App Store allowing for reuse across our application portfolio.

Select App Service

Select App Service

Call App Service

By creating a policy management service and publishing it to the private app store, we can share policy details across multiple applications. We used the policy information provided by our service for both the claims process and rating engine. The advantage of using App Services over web services is that App Services allow for multiple versions and allow for dependency checking. When we update our service, we will be able to see the dependent applications that rely on this service. By breaking our application up into services, our application will be more scalable and maintainable going forward.

So why choose a platform like Cloud Foundry?

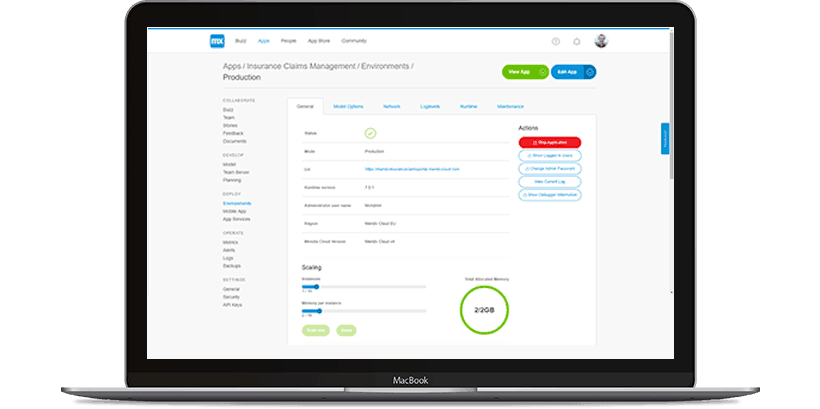

Behind every good set of services needs to be a reliable and scalable cloud platform. Here at Mendix, that comes out-of-the-box through Cloud Foundry. By combining Mendix and Cloud Foundry, customers benefit from the speed of Rapid Application Development underpinned by a scalable multi-cloud architecture.

Why is it so important for insurers then? Well, one of the major benefits of Cloud Foundry is its multi-cloud deployment. Cloud Foundry allows users to deploy to any infrastructure provider such as: AWS, Microsoft Azure, Google Cloud Platform & Open Stack. The Insurance industry, like many other industries, is highly regulated. One of the biggest concerns is data privacy and protection. Every country has different data laws with which insurers need to comply. By using a platform like Cloud Foundry, insurers can easily choose the IaaS (Infrastructure-as-a-Service) provider to suit their data protection needs, with the flexibility to switch at any time.

When launching a new innovative insurance offering, you hope it is a success and brings your company new revenue. But with increased success comes increased demand on your infrastructure. To cater for this, you need to have a platform that can handle the demand and scale. Using the Mendix Cloud platform built using Cloud Foundry, you can easily scale your applications to meet the increased demand. The Mendix stateless architecture allows demand to be spread across different runtime instances. The platform handles huge surges in traffic by spreading the load gracefully across these instances.

Another benefit that comes from having a stateless architecture is high availability. When hardware and software fails, the impact on your application can be huge, but it is important in critical applications that this doesn’t impact your users. By using a stateless architecture, any users using a failed runtime are seamlessly transitioned to another runtime instance while the crashed runtime is automatically replaced.

The Mendix Cloud comes with multi-availability zones to increase the high availability. In this case, the database has a warm-standby which automatically kicks in when requests to the primary database fail. The full Mendix application, both the runtime and the database, are spread out over multiple, fully redundant availability zones within an AWS region.

Key Takeaways

Many insurers struggle to innovate quickly and scale rapidly. This is often because of poor architectural and infrastructure decisions. As you have seen in this blog post, Mendix helps enterprises architect and scale their applications to meet increasing demand. You have seen what we built using the Mendix platform, now what will you build?