CasinoSoft Improves Accuracy in Compliance Reporting

With the flashing lights, partying, and the prospect of winning big, gambling provides a certain allure for casino patrons. But casinos can also be a hotbed of suspicious activities, such as money laundering, terrorist financing, and gun running. The U.S. federal government took notice, and passed the Bank Secrecy Act of 1970, colloquially referred to as Title 31, which requires casinos that generate more than $1M in annual revenue to remain compliant with the Financial Crimes Enforcement Network (FinCEN) of the Internal Revenue Service (IRS).

CasinoSoft, a software provider based in Las Vegas, has developed a comprehensive Title 31 solution for the gaming industry, known as ComplianceCore. Building on previous experience, CasinoSoft took regulatory guidelines and codified it into a solution that can be continually upgraded as new guidance from Title 31 is announced. Their offering digitizes activities required by the compliance process, creation and filing of taxes related to winnings, and automatically documents financial activities of individual players.

Compliance Regulations: No Gambling Matter

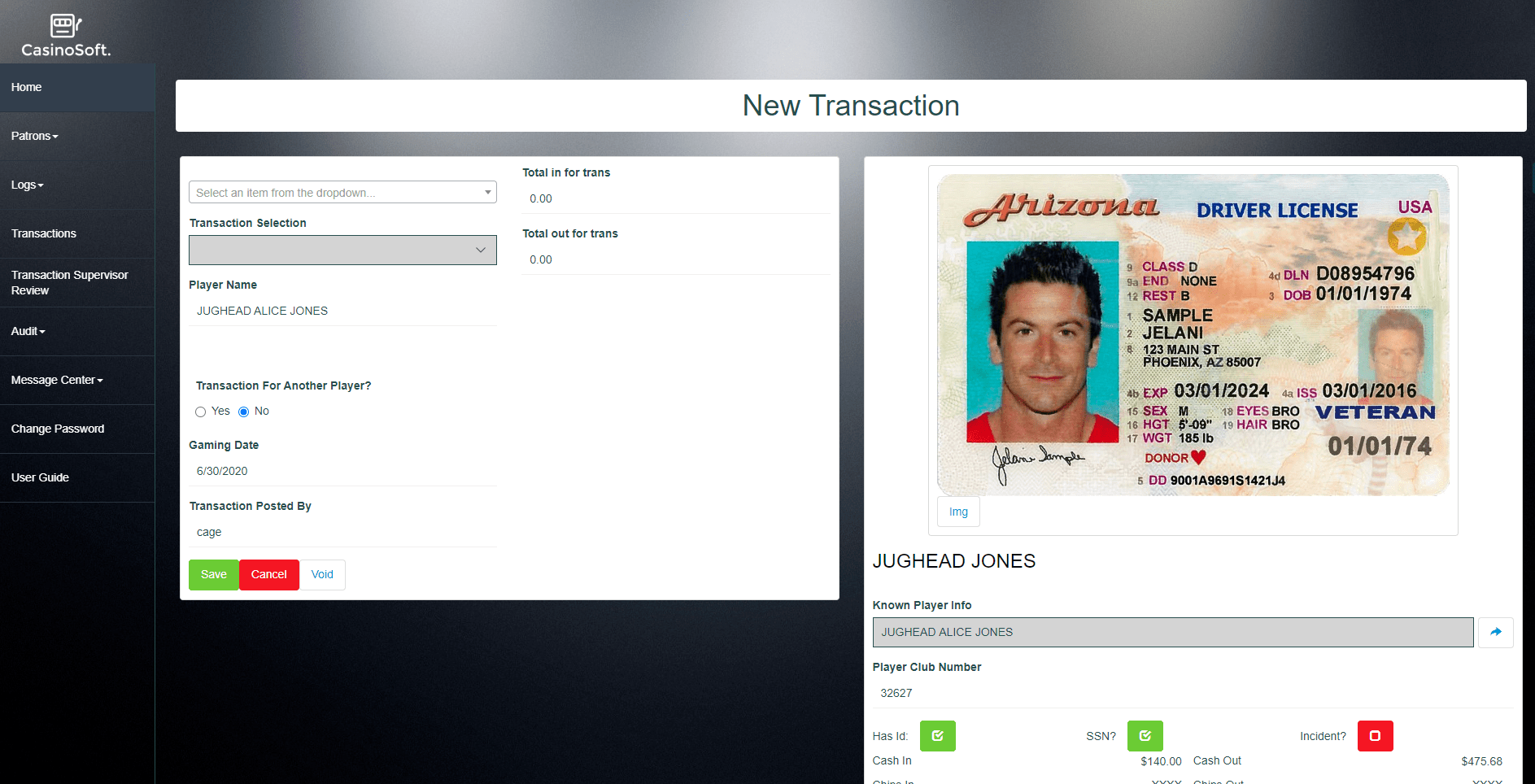

Every casino that falls under Title 31 regulation is required to report total currency transactions in excess of $10,000. On the surface this appears straightforward, but in reality, there are further complications: all transactions over a 24-hour period need to be reported, not just individual transactions. Every single play on a slot machine or table in the casino requires monitoring and feeds into this threshold in order to prevent players from hiding suspicious activity among a web of separate games.

The amount of manual work required to accurately track a player’s transactions in order to abide by the regulation is challenging and error-prone, making mistakes more likely in a manual process. “Casinos are paper factories,” Montano explains. Today, they are primarily printing out compliance documentation, creating massive piles of paperwork to deal with the following day. This creates a huge opportunity for efficiency gains, not to mention that the fines for non-compliance can reach the tens of millions of dollars, so the stakes are high.

Matt Montano, CEO of CasinoSoft, created an original version of ComplianceCore in 2006 that helped to automate and consolidate the actions needed to comply with Title 31, such as monitoring player behavior and identifying fraudulent gaming patterns. Back then, the team was primarily focused on custom-designed software for their enterprise clients. Likening the software development process to building a “tree house,” Montano found the design parameters and functionality requirements were constantly changing and evolving as the construction, or development process, took place. The custom-built solutions for their enterprise customers took priority, and their Title 31 solution took a backseat.

The Challenges of Dealing with Legacy Code

At the time, the Title 31 solution did not have the luxury of being built with agile methodology, making continuous iteration on the product nearly impossible. The need for agile changed after receiving a number of new requests from their customers and prospects alike. These requests, related to their Title 31 solution, made Montano realize that CasinoSoft needed to “tear [ComplianceCore] apart and rebuild it from the ground up” in order to be a modern, viable solution. Originally built using C# almost 15 years ago, few people at his organization could maintain, source, control, deploy, and build on their legacy product. While their architecture was functional, it was enormously challenging to make updates efficiently, creating a bottleneck in their product development lifecycle and making it difficult to meet customer expectations of keeping up with changes to Title 31 regulation. Despite having access to world class consultants with decades of anti-money laundering (AML) experience, simple workflows that cover recommendations from consultants could take six months to complete with little opportunity to deploy incremental changes.

Going All-In with Mendix

After searching for a new platform to upgrade their solution, they discovered low code and in six months were able to modernize their Title 31 compliance package, using none of their original code and recreating it all from scratch. Montano saved years of development time, bringing their production-ready solution to market more quickly. He explains that “when you’re dealing with an inflexible piece of legacy… it’s not as easy to deploy quick functionality enhancements on the fly to customers the way we could do with Mendix.” This modernization of both their compliance package and their development process has enabled them to codify regulatory guidance relating to Title 31, even as new legislation becomes part of the written law. ComplianceCore was brought to market at a fraction of the time, and their customers are using a solution that is up to date with changes in regulation. By taking subject matter expertise and leveraging the flexibility of Mendix, the CasinoSoft team is able to update their core product regularly as best practices and policies are updated.

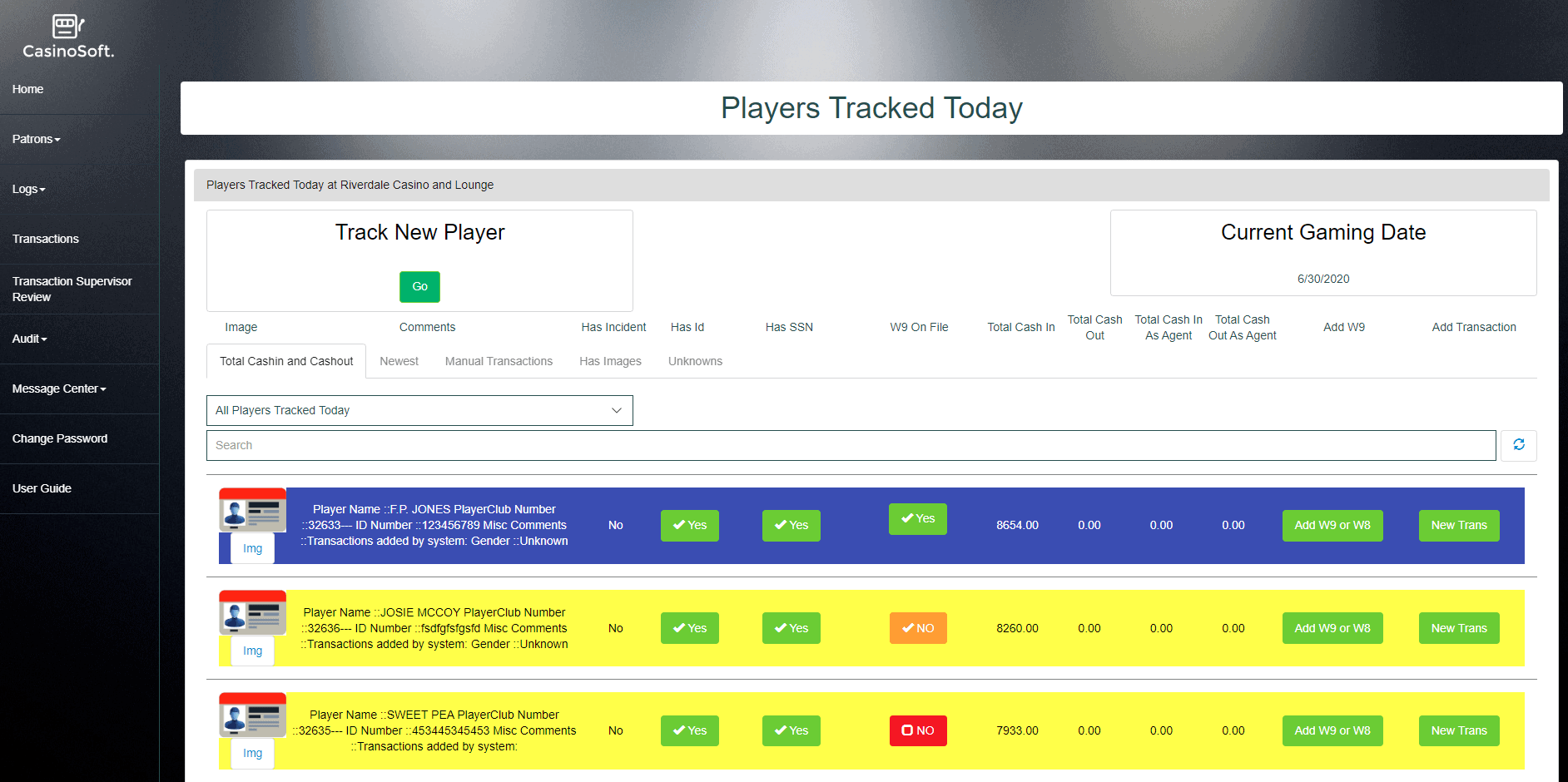

One of the most compelling offers the Mendix platform provides for CasinoSoft is the ability to integrate with legacy sources of data to extend functionality of the app. From common slot machines manufactured by Aristocrat Technologies, to table ratings and financial accounting data solutions from SG Gaming, Montano has been able to pull cash transactions from data feeds delivered directly from machine manufactures with no need for user interaction, reducing errors that can cost millions of dollars and freeing up time for casino staff to focus on less tedious tasks. Montano explains that their Title 31 compliance package has leveraged the automation and deep integration capabilities, “all feeding from various distinct sources of data into the Mendix back end” which is then “presented in a seamless front end,” also developed using Mendix.

Not only does CasinoSoft help their customers avoid the massive fines related to non-compliance, but they are also automating previously manual and time-intensive processes, giving time back to casino employees to perform the other tasks expected by the FinCEN. Tablet Taxforms, a component to ComplianceCore, digitizes and automates the tax paperwork related to Title 31. As a hybrid native-mobile app that minimizes the amount of paperwork casinos generate on a day-to-day basis, casino employees are now able to comply with Title 31 tax requirements without the need to manual sort through and file physical paperwork. Previously, an audit process could take upwards of 2 days to complete. With the CasinoSoft compliance solution, the average compliance team is now taking a mere 2 hours to submit required documentation to the federal government.

Winning the Jackpot

The CasinoSoft solution has been well-positioned for the future, as this extensibility is not only able to leverage legacy sources of data, but also accommodate new technologies as they emerge. Montano and his team are able to provide access to world-class compliance expertise by focusing on building business logic into their platform. They spend less time on maintaining and deploying code, and more time on developing the best product for their customers. This game-changing solution is pushing the casino industry into modern times, enabling automation for complex compliance guidelines.