Mendix for Financial Services

Accelerate your technology roadmap

Contact UsSatisfy the need to do more, faster

Mendix for Financial Services is an essential destination for organizations looking to set the benchmark for operational excellence, as well as customer and employee experiences. You’ll have access to industry-focused best practices and the people who create them. This integrated cloud experience connects customers to partners and a diverse, prolific developer community.

The Mendix platform enables financial institutions to develop enterprise-wide ecosystems using composability and reusability. Extend your applications using our digital marketplace, with out-of-the-box workflows, connectors to commonly used systems, and a wide variety of components that can be customized to suit your specific needs and rapidly deploy solutions.

Read more about Banking Solutions

Institutional Onboarding

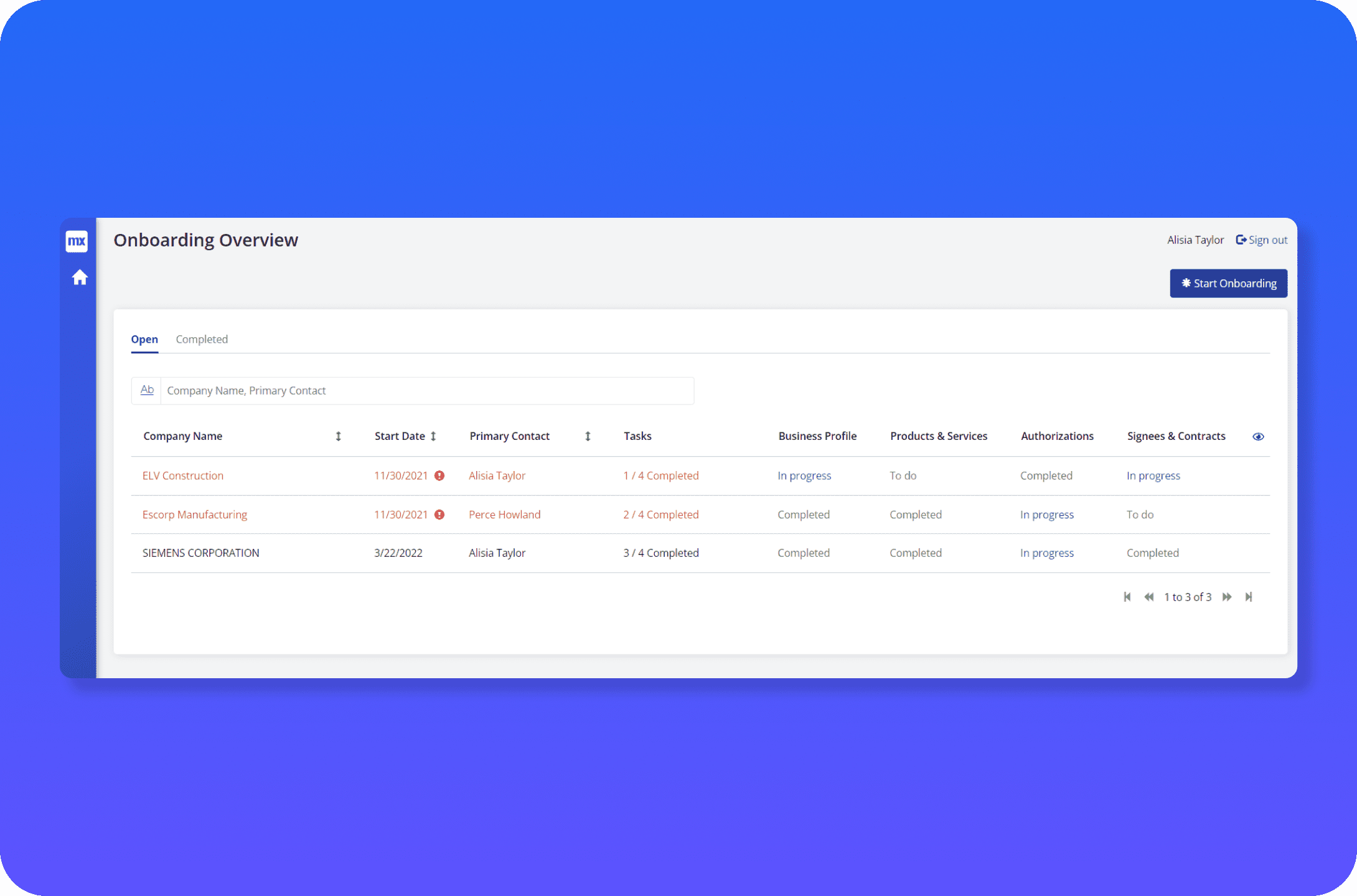

Onboarding a business customer is one of the most complex and critical tasks in the banking industry. All modern businesses know that a top-class digital onboarding experience is key both for speed to revenue for the bank and for customer satisfaction.

Banking clients use Mendix to improve their customer onboarding and Mendix Financial Services offers on Institutional Onboarding Template. This template gives your business an intuitive, easy-to-use accelerator that helps you quickly add process automation to this critical banking workflow. Proving your business customers an innovative and attractive onboarding process increases their trust in your business and keeps you competitive in a growing market.

Deploy first and increase speed to market, quicken the speed of ROI, and accelerate your business to the forefront of the market.

Learn more about Institutional OnboardingCompliance Complaint Tracker

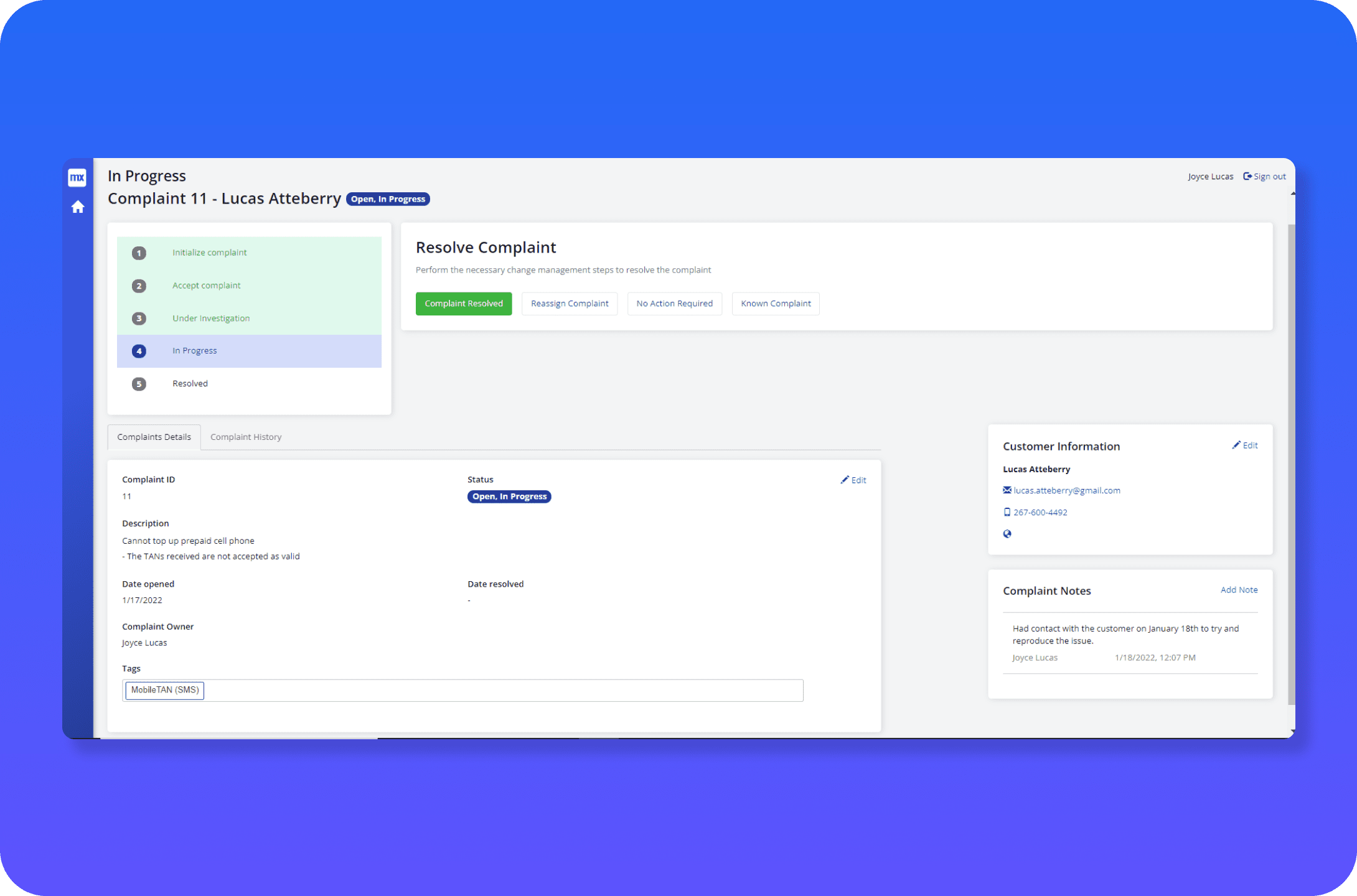

Financial Institutions are required by government regulators to track every customer complaint. Often, this is done with spreadsheets and the communications around resolutions of complaints is through email. Mendix offers this template to consolidate spreadsheet tracking and communications into a single portal for the entire enterprise.

Every complaint gets imported so that an owner can be assigned to assess and resolve the complaint. This template not only accelerates resolution of complaints, but also creates formal records to be retrieved during future audits.

Mendix Compliance Complaint Tracker provides your institution with a modern application to streamline your customer complaint resolution process. This directly results in reducing significant FTE hours and eliminating the burden of future audits.

Learn more about the Mendix Compliance Complaint Tracker

Mortgage Origination

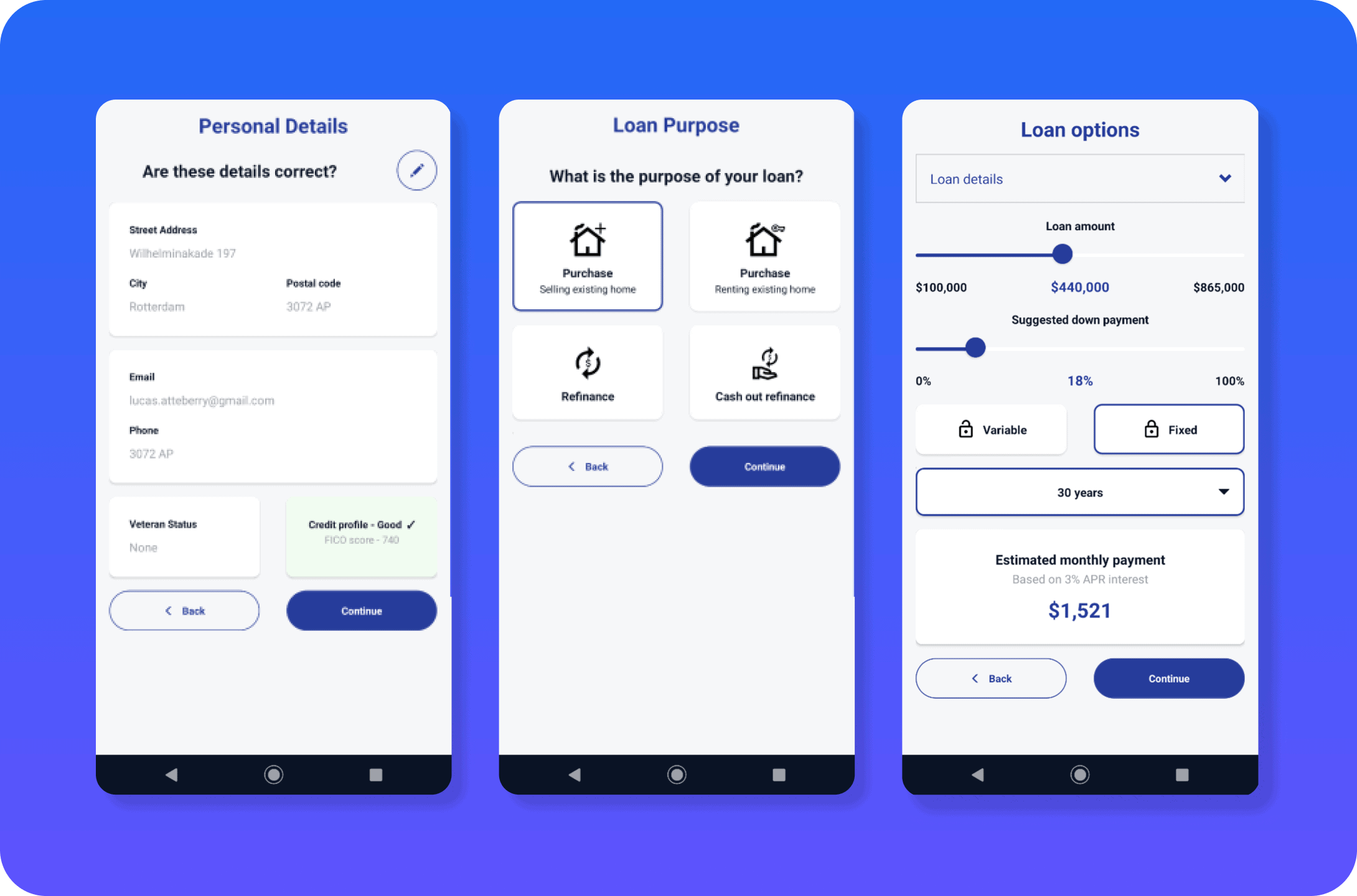

The digital experience is greatly enhanced with your mortgage applicants guided through a workflow. The native mobile application features include everything required for your customer to easily input their information with the assistance of OCR data processing and upload documents. There are schedule features to arrange an appointment with their loan officer and be prepared with their printed pre-qualification letter once the application proess is completed and executed with the integrated e-signature function.

Policies and procedures are enforced in this template to ensure that loan officers close more opportunities, but seamlessly integrate with the CRM, POS, and LOS systems.

The Mendix Mortgage Origination Template application accelerates your speed to market and eases the burden on your development teams with our modern application development platform. This template may also be used to jump start additional initiatives in the lending business units by reusing common functional components.

Mendix makes the complex simple, which results in making your customer experience jump ahead of your competition.

Learn more about Mortgage OriginationExplore the Mendix Partner Ecosystem for Financial Services

Trusted by

Helpful Resources

Streamlining Digital Transformation in Financial Services

Read the Streamlining Digital Transformation in Financial Services white paper and learn about the options available for you to build a solid foundation with technology, maximize ROI, and minimize complexity.

Mendix Low-Code for Financial Services

Financial institutions can build better apps faster on the Mendix platform. Modernize internal processes, add process automation, and more.

Embedded Finance Made Simple with Mendix

Mendix, the leading low-code enterprise app development platform, makes it simple to do everything from orchestrating multiple API calls to building business monitoring UIs.

Mendix for Financial Services: Customer Onboarding

The Mendix Customer Onboarding solution template combines your needs and systems into an onboarding experience that’s uniquely yours and will wow your customers.