Digitize, Accelerate, Automate with Mendix for Insurance

A digital transformation platform for the insurance industry

Explore the PlatformAssemble New Customer Experiences. Accelerate Business Transformation for Insurance.

Why shop for stand-alone solutions that fix challenges in only one area of the business? The more disparate solutions across the enterprise, the harder digital transformation gets for insurers, reinsurers, and intermediaries.

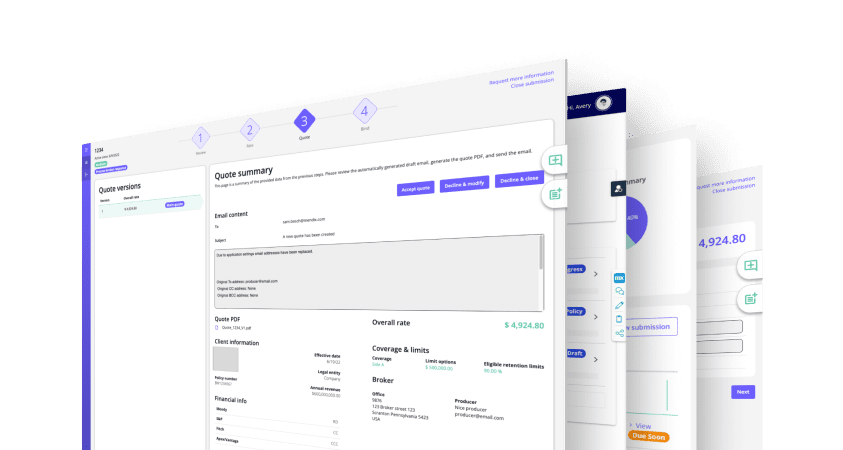

Stop creating an unmanageable technology stack by focusing on stand-alone solutions and start thinking of enterprise-wide resolution. The Mendix application development platform can transform processes across property & casualty, life, and health insurance in multiple disciplines ranging from distribution to underwriting to claims.

Learn more about how Mendix can be applied to key insurance departments:

Customer Stories

MS Amlin Digitizes Underwriting and Claims Management

Erie Insurance Creates a Native Mobile App Without Mobile Developers

Rapid Innovation Across the Insurance Customer Journey

Insurance Contract Management Made Transparent and Efficient

Corant Gains Competitive Advantage in a Global Insurance Market

Align Business and IT to Enable Rapid Software Development

Low Code Straight-Through-Processing Transforms Insurance Business Operations

Explore the Mendix partner ecosystem for Insurance

Trusted by

Helpful Resources

Simple and Intuitive Insurance Experiences

What if requesting a quote online was seamless and instant—rather than a cumbersome process? Find out how the Mendix platform simplifies this and other direct-to-consumer insurance experiences.

Accelerate Digital Execution with Mendix & AWS

Download the playbook, Accelerate Digital Execution with Mendix & AWS, to learn how digital transformation will unlock the potential of your cloud investments.

Revolutionize Insurance Claims Handling

One of the key challenges of claim handling is its complexity. The process of receiving, processing, and settling a claim involves multiple steps that must be followed in a specific order.