Banking App Development: The New Starting Line

The new ebook from Mendix and Intellyx, Gaining Ground: Winning in a Hypercompetitive Mobile-First Market, shows financial services firms that a strong mobile banking software solution is imperative for future success. Mendix can help you get that winning solution to your customers fast. And that’s just the beginning.

Saying that strong mobile banking experiences are table stakes for financial services firms at this point just isn’t true. If anything, that’s an undersell.

With nearly half of customers switching banks because of subpar mobile, it’s not enough to have what everyone else does. Your mobile experience has to get customers what they need in the moment with minimal friction. That’s the key to success.

But the conversation comes back to old paradigms of “build vs. buy.” The cost to develop a mobile banking app from scratch is too expensive, and buying off the shelf doesn’t get you ahead. You’ve probably heard this before.

Mendix specializes in enabling best-in-class mobile experiences for financial firms. But here’s something you might not know. That first experience can lead to so much more. Let’s explore.

Mobile Apps That Matter

Some of the key pillars for Mendix are speed and ease of use. It might sound like a bit of a misconception to say that anyone can build a native mobile app with the Mendix platform. But, with the right people and ideas, it’s 100% true and something that can be deployed quickly. Mendix users worldwide utilize the platform to deploy business-critical solutions better and faster than traditional development.

Further, there are stories from around the globe of banks using Mendix to take control of their mobile experiences. For example, look at the story of Al Baraka.

This bank saw massive success in South Africa, which attracted competitors with intuitive and accessible mobile apps that Al Baraka couldn’t match. Using the Mendix platform, Al Baraka swiftly built and deployed a mobile app that replaced many in-person offerings and helped bolster business in the region.

Your New Development Toolkit

To help get development to hyperspeed, Mendix has starter templates designed to solve some more common banking problems. The beauty is that these are built specifically to work with existing core banking systems, are easy to customize, and are meant to deploy fast. No long development periods, no painfully slow iteration times. Get your project started, and get it out to market quickly.

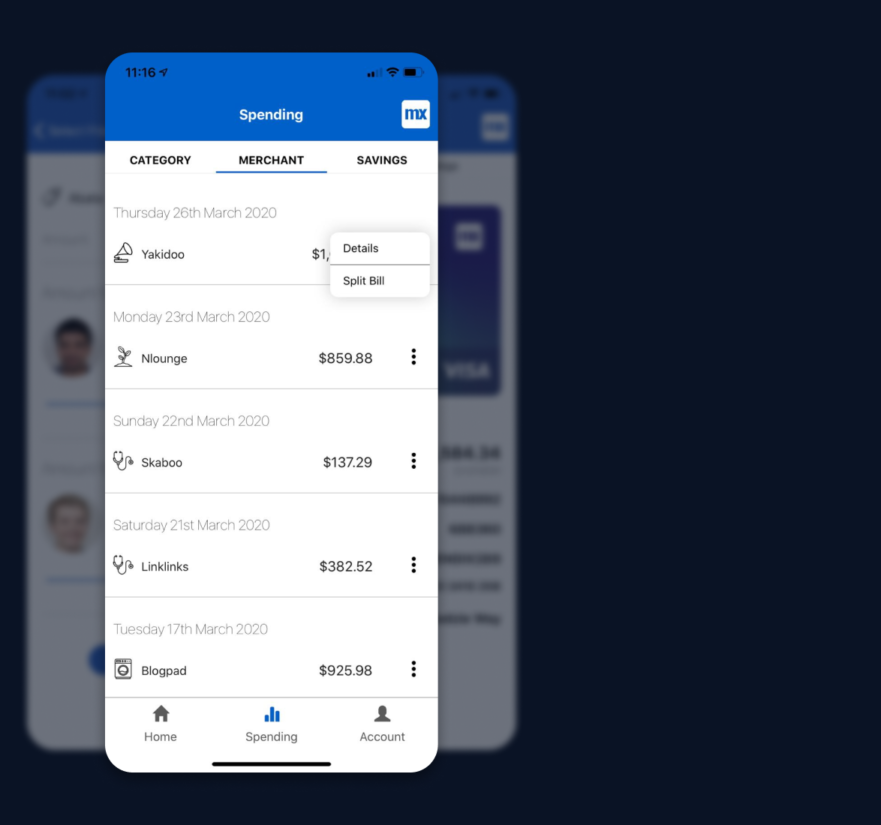

The Native Mobile Banking template has everything any bank could want from a native mobile app. Biometric login, account views, transfers, P2P, payments, AWS-fueled chatbot, and more. And this is all backed up by a best-of-breed development approach as it’s built on React Native and offers top-in-class security.

Rabobank, a leading international cooperative bank, used Mendix to deliver a new native mobile version of their savings portal for more than 500,000 customers. Mendix enabled the bank to prototype and iterate quickly, increasing efficiencies and opportunities for business and IT to collaborate.

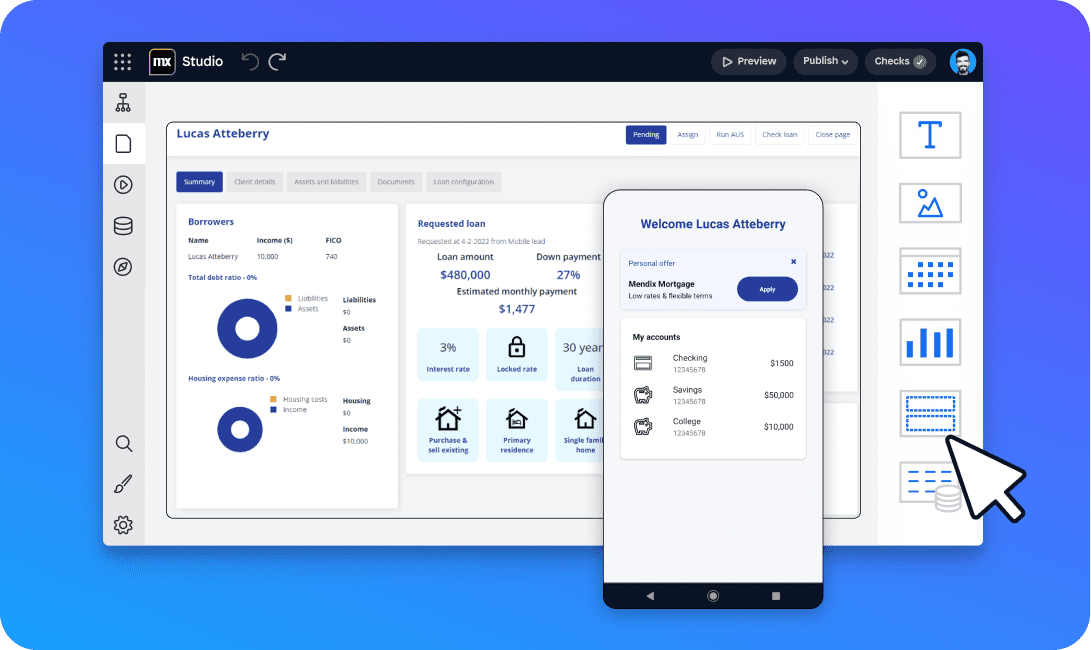

Mendix also has mortgage lenders in mind with the Mortgage Origination template. The result is a mobile-ready workflow designed to streamline the customer experience by utilizing on-hand data. Customers can validate their data, upload, and e-sign right from their mobile device.

Because you can get these templates to market so quickly, you might be tempted to kick back with a cold drink. Absolutely celebrate that first success, but don’t stop there. Mendix can do so much more for you.

One Component, Multiple Applications

Anything built on the Mendix platform is made up of a lot of different components and workflows. With Mendix, though, those components aren’t just single-use. Everything can be taken and reapplied throughout your ecosystem.

So that approval workflow that’s a part of the Mortgage Origination template? Because it’s already built, you don’t need to spend time starting from scratch. This doesn’t just have to sit on the consumer side of the business either!

Many firms struggle with the payments approval process, with many of those things still happening via email, spreadsheets, or other cumbersome processes. That opens firms up to slow approvals and fraud, among other unsavory possibilities.

Now, imagine a request coming in from a VIP customer. The flow from accounts payable to AP management and even all the way up to a CFO level can stay in the app with a simple push notification. No more lost emails, no more fraud risk, and a strong paper trail on top of that. Multiply your organization’s time and resource savings, and you can see incredible, newfound efficiencies.

Mobile Wins Customers and Enables Growth

If you’ve come to Mendix to create an elegant, intuitive, top-notch mobile app, you’re absolutely in the right place. No other development platform can touch the Mendix platform’s speed and features. You can separate from your competitors and leave them scrambling to catch up.

But the real long-term growth opportunity comes from taking those pieces from your new mobile app and repurposing them across your enterprise. Your new mobile app can unlock your roadmap for years to come.

Look at our financial services templates and think about everything your firm could gain.