MS Amlin Digitizes Underwriting and Claims Management

Operating in the Lloyd’s, UK, and Continental European markets with a 300-year record of delivering top customer service and a focus on complex and demanding risk, MS Amlin is a well-regarded name in the European specialty insurance market.

MS Amlin’s expertise in underwriting and flexible approach has led it to £3.7 billion in annual revenue and a staff of approximately 1,800 employees in more than 20 global locations. They are part of the MS&AD Insurance and Reinsurance Group, a top-10 global provider.

Katie Wolff, Head of Digital Trading at MS Amlin, described MS Amlin’s commitment to digitalization and automation with their ongoing Go Digital initiative:

The end goal was to “automate the end-to-end process fully…from data entry, preferably by brokers or our distribution partners, through to accounts reconciliation and the claims management process.”

For an organization like MS Amlin that specializes in complex accounts, this solution had to be expansive and required speed and flexibility. Wolff, along with André van Teeseling, Director and Chapter Lead of Low-code at First Consulting, and Rob Versluis, Customer Success Manager at Mendix, joined Mendix World 2021 to chronicle how this solution came together.

Differentiation through Automation

The end-to-end solution the team at MS Amlin envisioned would offer several key benefits, both to MS Amlin’s customers as well as to the business.

Moving the full customer lifecycle to a digital-first model would allow MS Amlin to offer a more standardized core product set. Streamlining the number of initial offerings would then allow customers more flexibility to get to the solution that best fit their needs.

The proposed solution would also enable the business to better lead product development, evolving each solution based on known and upcoming client needs.

For customers, the goal was more self-service. This would lead to increased client satisfaction by speeding up processes and reducing paperwork. By having everything available in an online portal, clients can also see the full breadth of MS Amlin’s offerings, increasing upsell and cross-sell opportunities.

For MS Amlin, that flexibility and added value are true differentiators.

Finding the Right Fit

Because of the complexities of their organization, MS Amlin required several different suppliers rather than a one-size-fits-all option. As Wolff described, “We didn’t want to have to compromise on the flexibility required to meet all of our requirements.” A priority was choosing partners who “could grow with us on our digital transformation,” Wolff continued.

MS Amlin selected Socotra for their core Policy Management Solution and FinTech OS for invoicing and payments.

To bring it all together, MS Amlin went through a proof-of-concept process with several providers and ultimately chose the Mendix development platform.

First Consulting, as an Expert Mendix Partner, would primarily be responsible for the development.

Low-code Building Blocks for an End-to-end Solution

The MS Amlin project was one of the largest and most complex van Teeseling had seen in his seven years working with Mendix. As he described, it “became clear to us that we really needed to have a special solution that on one side was able to provide the generic functionality and to standardize and harmonize the way of working.”

To get there and add flexibility, the team used two core concepts:

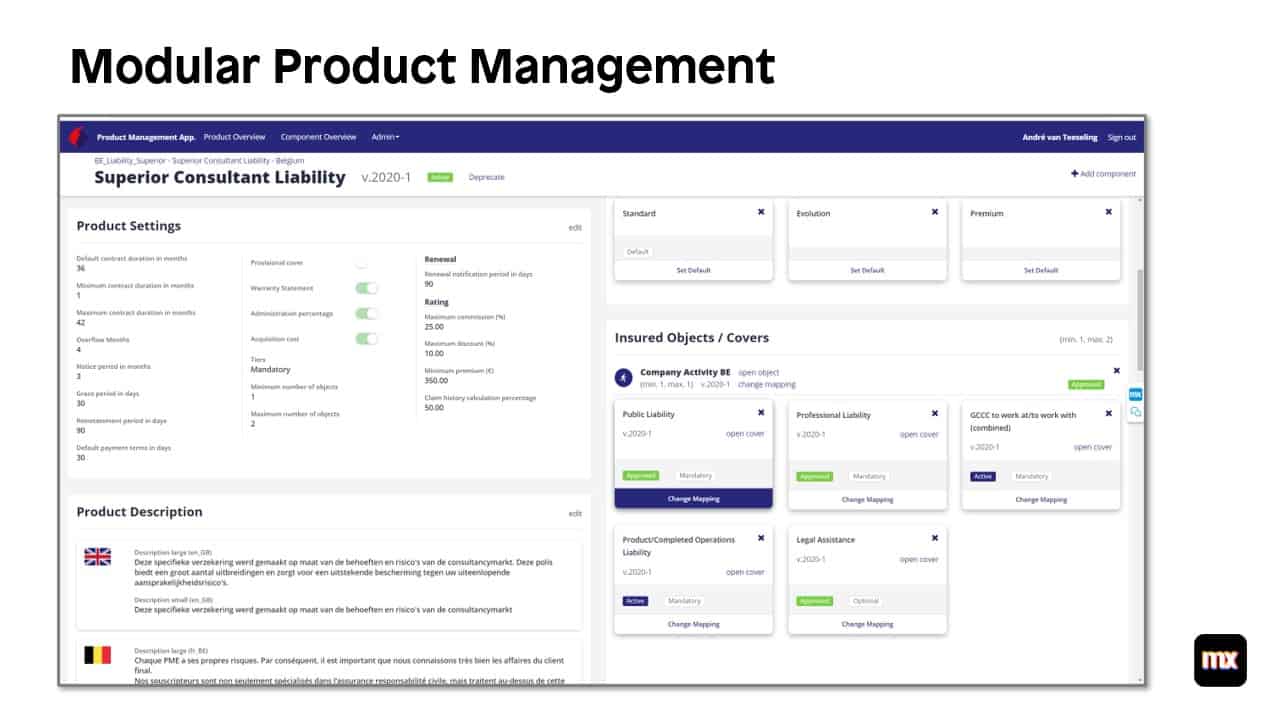

- The first is the Modular Product Approach, which van Teeseling described as where “a product consists of object types and definitions, what you insure and for each object, you can also define other components like covers, clauses, wordings.” This modularity would let MS Amlin be able to create, iterate on, or swap out smaller components in their program without needing to reconfigure the whole thing.

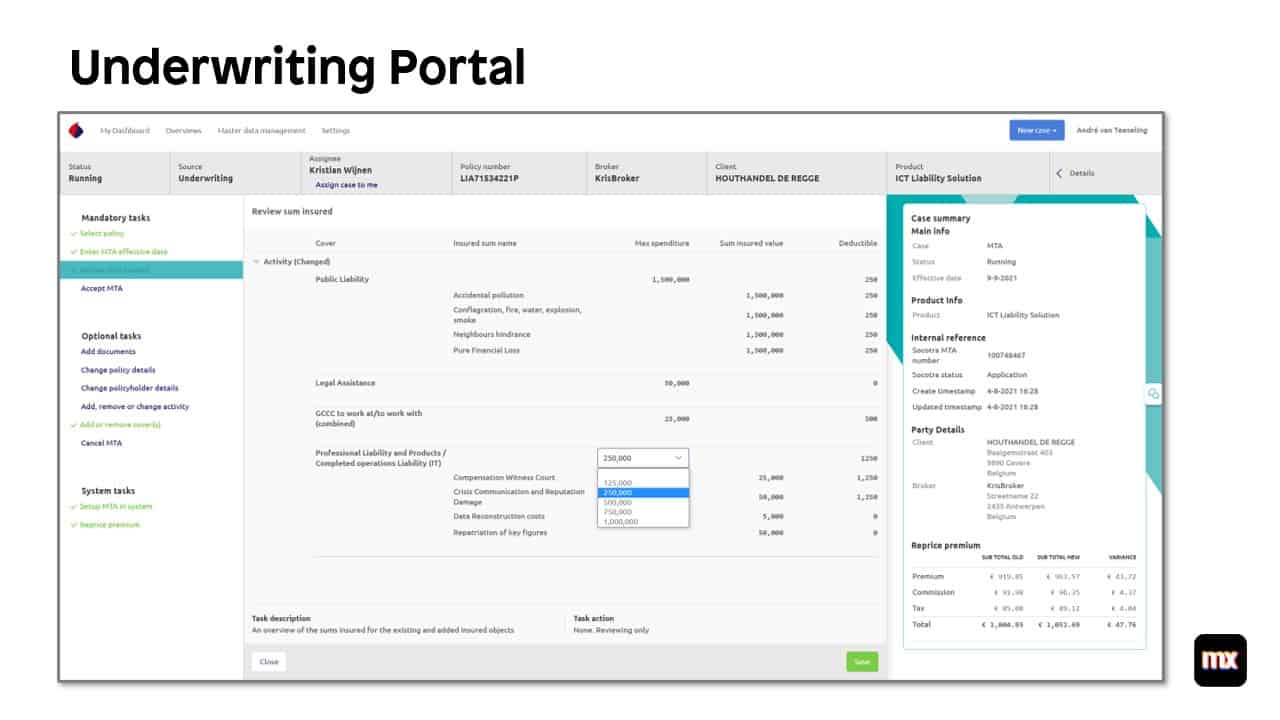

- The second core concept is Dynamic Case Management. van Teeseling explained, “This allows you to define generic process steps, so generic functionality…but with business rules that we can configure for the different products and the different countries.”

Putting the Pieces Together

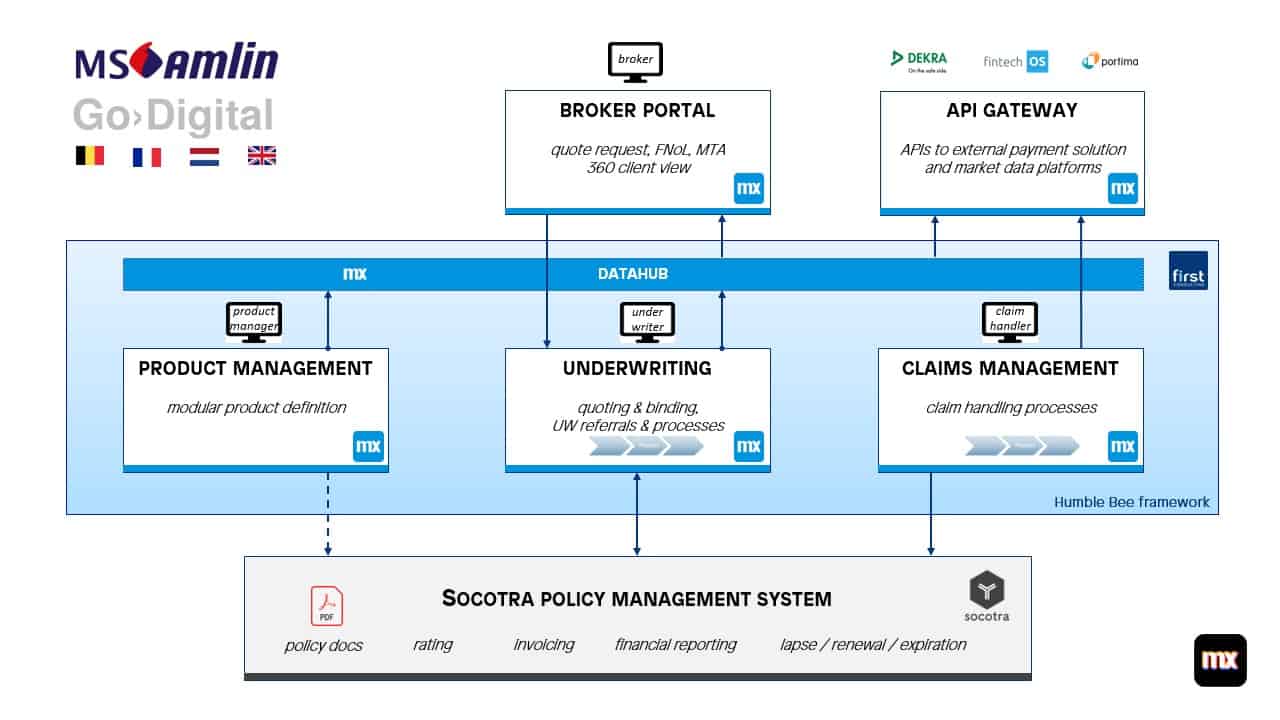

The teams at MS Amlin and First Consulting decided on a three-layer solution to implement this end-to-end experience.

Everything is built on top of Socotra as the Policy Management System, “the truth about the policy, and the life cycle process by the policy,” said van Teeseling. On top of that layer is a landscape of Mendix apps and microservices covering all of MS Amlin’s processes.

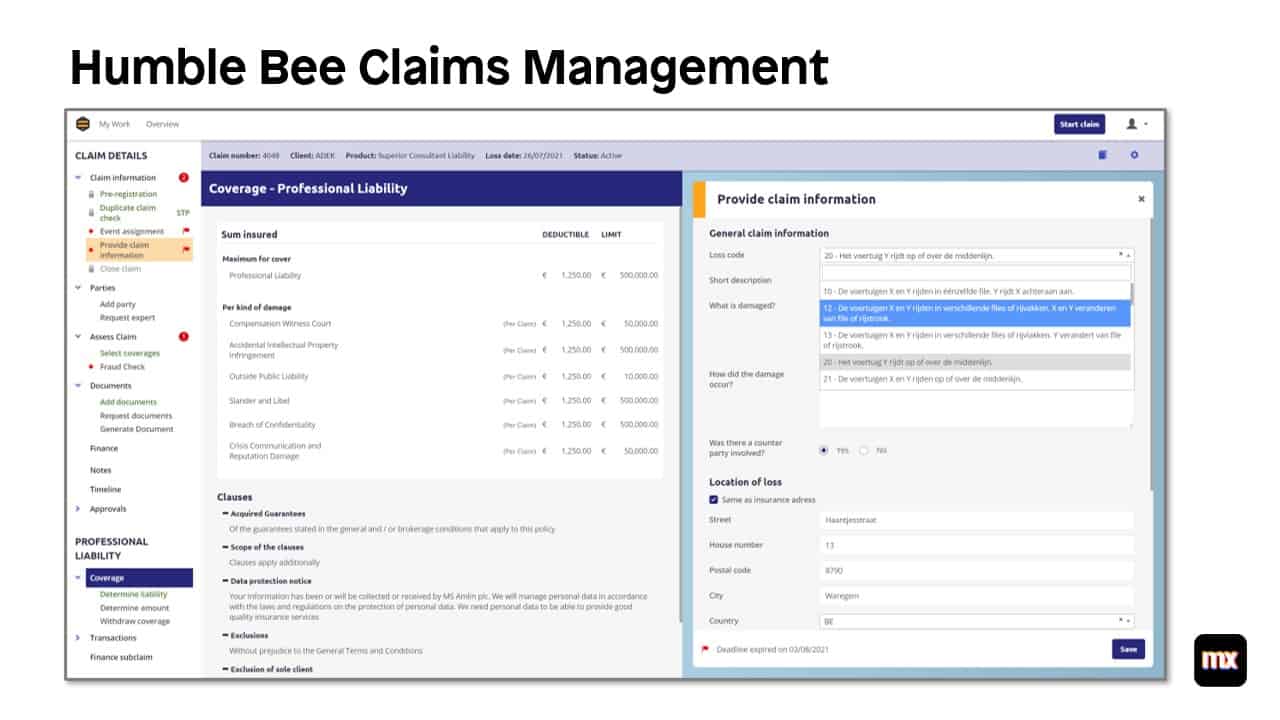

MS Amlin and First built this layer using First’s Humble Bee Framework. Humble Bee is a suite of solutions designed specifically for the insurance industry. API-driven integration and First’s Dynamic Case Management principles help create a better digital customer experience through providing enhanced collaboration and advanced analytics.

Finally, on top of that are several end-user applications.

The first is a Product Management Application. van Teeseling described, “The Product Manager can configure the different products and components and reuse these for the different countries and things.”

At a glance, an MS Amlin Product Manager sees all options available and customizes depending on the customer profile.

Next is an underwriting portal for processes such as referrals and quotations. Further, Humble Bee is used as the base for an application to implement MS Amlin’s digital claims processes.

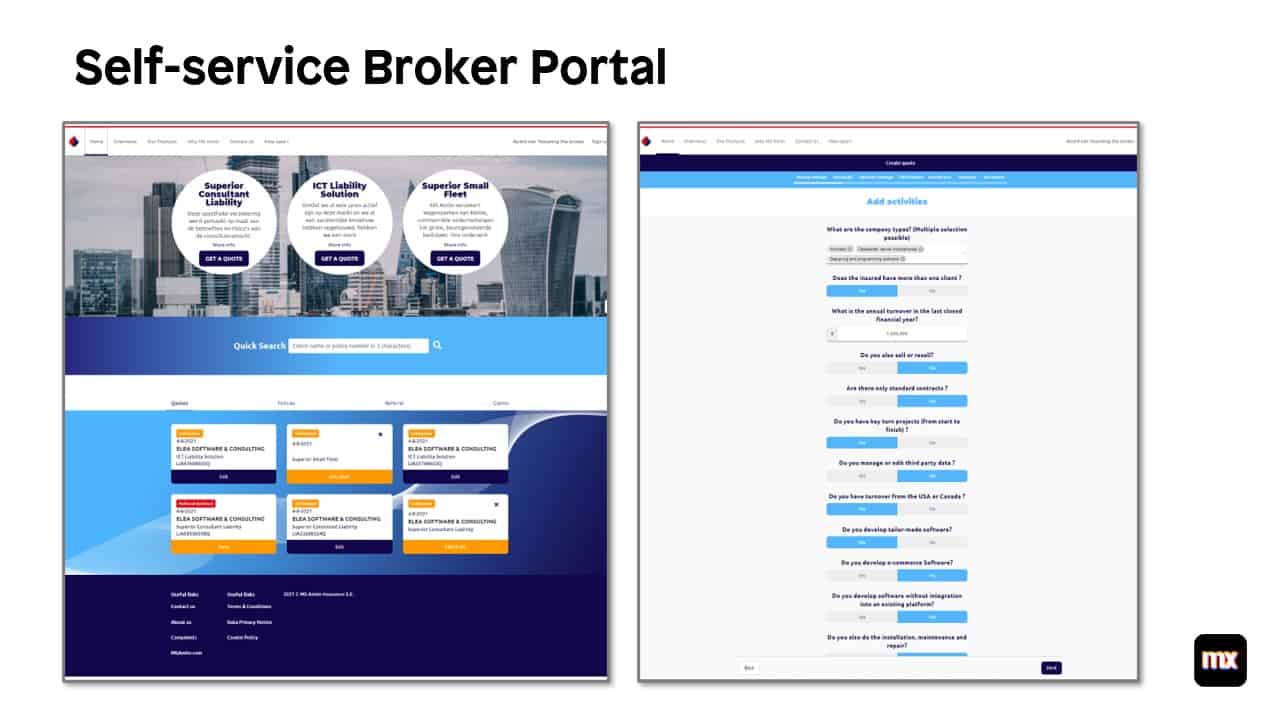

Last but not least is a new broker portal.

This solution allows brokers to perform self-service on many operations, but it also acts as a “gateway to connect to external data platforms, like for broker platforms or for payments like FinTech OS.”

To simplify bringing all these different platforms and solutions together, the team used the Mendix Data Hub to manage integrations. Data Hub is an open, standards-based metadata repository designed to bring together all of an organization’s data. With Data Hub, MS Amlin understood how their applications connected to each other and could control how data is shared.

Further, it allowed MS Amlin to bring in a third party like First Consulting to work with that data as they created the new application landscape. Looking toward the future, MS Amlin could even integrate external data sources as needed.

Speed Leads to Scale

Even with the complexities and size of the project, MS Amlin and First Consulting combined to complete the end-to-end platform in under a year. Wolff reflected on the accomplishment and what it means:

The platform has already rolled out in Belgium and will be a base for MS Amlin’s business for years to come.

Building on this initial success, MS Amlin is planning to replicate these initial builds for their operations in the Netherlands, France, and potentially the United Kingdom. The flexibility of Mendix will allow these new builds to happen quickly, decreasing the amount of development resource spend and increasing ROI.

MS Amlin also plans to move processes away from legacy systems and onto the Mendix Platform, saving maintenance time and license costs.

According to Wolff, there were several keys that led to MS Amlin being able to achieve their goals. First, “having a digitally focused team sitting in the heart of the business has been fundamental,” she related. Further, adopting and sticking to an agile mindset has given the ability to show progress to senior stakeholders.

Finally, both MS Amlin and First Consulting stuck to the initial scope. Because of the flexibility of Mendix and ability to iterate quickly, the team was inundated with additions and change requests, “but that would have distracted us from achieving our overall end-to-end aim.” Having a single goal allowed them to reach their target.

Ambition to Results

In less than a year, MS Amlin went from a very ambitious plan to automate underwriting and claims processes with an end-to-end solution to a release that is serving a significant portion of their business.

“It’s of utmost importance to actually get this right from the outset,” Wolff reflected. “I’m sure that many, many people didn’t believe that we could do it in the nicest possible way. But, we have gotten to the point now where we have developed and are about to launch.”