Policysense: The First World-Class Insurance Software Suite 100% Developed on Low-Code

The insurance industry, along with banking, is at the core of the free world economy. Just as the insurance industry is critical to the free market, a high-quality insurance core system is critical to the success of insurance companies.

Insurance core systems have become increasingly important in recent years as they provide insurers with the flexibility and agility they need to stay competitive in a constantly evolving industry. Policysense is one such system, providing insurers with a world-class software suite that is 100% developed on low-code, making it highly adaptable and easy to modify as business needs change.

Software development has to be quick and responsive to keep pace with a constantly evolving tech landscape. The global shortage of developers, makes it essential to democratize the software development process. By doing so we open development to other professionals, such as businesspeople, to meet the demand. According to a recent article by Forbes , there is indeed a shortage of developers worldwide, which is driving the need for tools like low-code platforms to enable non-technical professionals to contribute to the development process.

The Solution

Policysense is a suite of cloud-native modular solutions that enable and accelerate the digital transformation of an insurer’s critical processes, combining the most advanced technology with deep business knowledge.

Each component of the Policysense suite has been built with three main business objectives in mind: increasing sales, reducing operational costs, and minimizing risks. The suite is fully based on low-code and is offered via a SaaS model, allowing for agile delivery projects that are guided by expert staff. The modular solutions can be purchased and deployed separately, and quick customizations can easily be made based on specific business needs.

Policysense stands out from other insurance software suites with its unique set of features and capabilities. It boasts a fully integrated yet modular coverage of the entire insurance business, making it highly adaptable and customizable to meet the specific needs of each organization. Policysense is also focused on the experience of policyholders (CX), channels (AX), and employees (EX), ensuring that all stakeholders are taken into consideration.

Policysense covers the entire value chain of an insurer. Insurers will benefit from:

- Agile delivery projects that are guided by our expert staff

- Modular solutions that can be purchased and deployed separately

- Quick customizations based on your specific business needs

Policysense’s Components

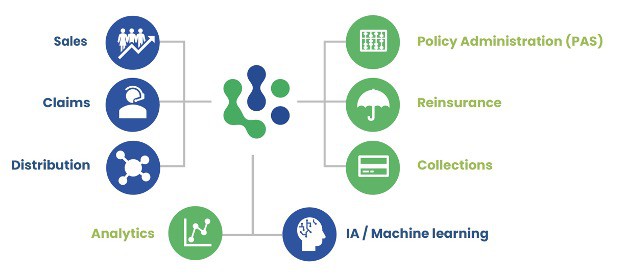

The suite offers several components, including Sales, Distribution, Claims, Policy Administration (PAS), Reinsurance, and Premium Collection. The Sales solution is an omnichannel sales platform that provides self-service capabilities for customers and channels, while the Distribution component offers an efficient way to manage economic agreements and compensation across all types of channels, ensuring legal compliance and goal attainment.

The Claims module offers speed and self-service for customers and suppliers using digital processes and interactions, while the Policy Administration (PAS) component provides innovation and quality of service throughout the entire policy lifecycle. The Reinsurance module easily controls and administers all forms of risk distribution, and the Premium Collection component offers efficient automation for premium collection.

All these components rest with an Analytics and IA / Machine learning features that leverage from all business data to improve process and gain unprecedented productivity levels.

Policysense Kernel

Policysense subscriptions include a set of common services at the core of the platform, known as the Kernel. These services include portals, teamwork tools, a secure message center, a product configurator, underwriting, workflows, user management, a client repository, approvals, and a rating engine. Policysense’s low-code architecture makes it easy to customize and adapt these services to meet the specific needs of each organization.

Low-Code based on Mendix

In Motion, creator of Policysense, after several months of studies, analysis and evaluation, chose Mendix as its low-code platform.

Policysense’s entirely low-code architecture based on Mendix makes it easily adaptable to meet changing business needs. The suite is continuously improving through new versions that are easy to receive, making it a future-proof solution for organizations. Finally, Policysense’s cloud-native technology with a microservices architecture allows for highly performant and efficient use of the cloud, while also enabling easy adaptation and modification of the system.

Policysense’s Functional Characteristics

- Available for life, health, property and casualty, with advanced functionality for each case

- Individual, group, retail, micro-insurance and on-demand policies

- Self-service capabilities throughout the entire value chain

- Compatible with traditional distribution models, embedded insurance, retail channels and digital distribution

- Historical information on key system transactions

- Enhances teamwork and collaboration

- Multi-currency

- Available in Spanish, English and Portuguese

- Oriented towards ecosystems and marketplaces

Benefits for Insurance Companies

One of the most important benefits is the optimization of critical processes, which can be tailored to the specific priorities of the organization. Policysense allows for quick customization, adapting to the rapidly changing market conditions to help businesses stay ahead of the curve.

Another significant benefit is the flexibility to react immediately to new opportunities in the market. Policysense provides a higher return on investment, making it an excellent choice for insurers looking to maximize their resources. Additionally, Policysense doesn’t require IT infrastructure, which can save businesses a significant amount of money over time.

Delivery and usage guidance is offered by experts who are highly experienced in the field. This means that organizations can rely on the expertise of the Policysense team to help them get the most out of the suite. Whether it’s guidance on how to use the suite or advice on how to optimize business processes, the Policysense team is always available to help.

Overall, Policysense is an excellent choice for businesses looking to optimize their operations, increase efficiency, and stay ahead of the competition. With its cloud-native modular solutions, quick customization, and expert guidance, Policysense provides businesses with the tools they need to succeed in today’s rapidly changing market.

Main Differentiators

Policysense stands out from other insurance software suites with its unique set of features and capabilities. It boasts a fully integrated yet modular coverage of the entire insurance business, making it highly adaptable and customizable to meet the specific needs of each organization.

The suite’s digitalization of business processes helps organizations streamline their operations and increase efficiency. Policysense also offers extensive and secure integration capabilities, allowing for easy integration with other systems and tools. The advanced functionality of Policysense is based on international experience in 20+ countries, giving organizations the confidence that they are utilizing a proven solution. The suite also offers regulatory support, ensuring that organizations remain compliant with relevant regulations.

Policysense is continuously improving through new versions that are easy to receive, making it a future-proof solution for organizations. Its low-code architecture makes it easily adaptable to meet changing business needs. Finally, Policysense’s cloud-native technology with a microservices architecture allows for highly performant and efficient use of the cloud, while also enabling easy adaptation and modification of the system.

Thrill Tech Behind The Scenes

Policysense takes full advantage of the benefits of cloud computing, with native horizontal elasticity that can be automatically adjusted based on demand, as well as vertical elasticity. The entire suite’s functionality is built on fully encapsulated microservices that use asynchronous events base on Kafka to communicate with each other. Because it is built on low-code, adaptations are simplified, and if desired, a high degree of provider autonomy can be achieved. The suite has been developed following DevOps principles, including automated deployment, infrastructure as code (IaC), and automated testing, making updates simple and low-risk.

Also, Policysense’s entire suite is built following the microservices pattern. These are fully encapsulated microservices, each with its own logic layer, database layer, and UI layer. Each microservice is deployed on its own Docker container, and all containers are orchestrated by Kubernetes. This allows us to scale horizontally based on system demand, making Policysense highly performant regardless of the load on the platform.

Similarly, the encapsulation of each microservice allows the system to scale based on demand on each microservice individually, without having to scale the entire suite. This makes much more efficient use of the cloud, as scaling only those microservices that require it reduces unnecessary resource usage.

In summary, Policysense’s use of microservices allows for highly performant and efficient use of the cloud, while also enabling easy adaptation and modification of the system. This makes it a top choice for organizations looking to optimize their performance and scalability while minimizing risk and resource usage.

Conclusions

Policysense is a state-of-the-art Insurance Suite Software that offers a wide range of features and capabilities for businesses of all sizes. As the first insurance world class software built 100% on Low-code, it provides unparalleled flexibility and ease of use, allowing businesses to innovate and transform their operations in exciting new ways. With Policysense, you can streamline your insurance processes, reduce manual labor, and improve accuracy, all while saving time and money. Contact us today to learn more about how Policysense can help your business achieve its full potential.

For more information please visit the solutions Policysense Distribution and Policysense Sales on the Mendix Solutions Gallery.