Small Step = Giant Leap: Mortgage Origination Goes Digital (Again)

Mortgage origination costs have doubled since 2008, but the average process time hasn’t drastically sped up. With regulatory compliance needs a must, many organizations don’t have the capacity to revamp their wholescale digital transformation and add further lending process automation.

And that’s where new players are stealing market share.

What’s the play?

New, disruptive players, an uncertain economy, and ongoing disruptors like crypto mean that the pace of digital transformation in the lending industry is greater than perhaps it’s ever been. Modernizing core systems is just one mission-critical factor lenders consider every day.

Because the pace of change is so high, most lenders focus on short-term wins and ROI. There’s no time for grand, new visions and wholescale digital transformation. Budgets and resources are too tight and constantly under stress.

But it’s precisely because of that volatility that lenders must focus on the longer term. Newer competitors have a digital-first vision focusing on the end-to-end customer experience with defined technology architecture, and they’re gaining market share by the day.

The new Digital Lending Transformation Playbook gives lenders and mortgage originators a new path to change the organization without having to trade out every core system. When there is parity between build versus buy, the calculus around digital transformation has to change.

Past success < > future results

Lenders want modern platforms, improved efficiencies, and a focus on innovation, but they don’t want wholescale change that disrupts core business. Focus on solutions, focus on ROI.

From up high, that seems practical. Fueled by the late-2000s market crash and, more recently, COVID, lenders have long embraced things like AI and process automation. When considering the current boom in business, market factors leading to a hire-and-fire mentality, and the need to stay on top of continually-evolving regulatory requirements, buying solutions that fit with existing core systems without a ton of fuss feels like the right play.

But tacking single-point innovations onto aging core systems results in a fragmented and frustrating customer experience that doesn’t take advantage of the data organizations already have about their customers.

McKinsey states, “95 percent of home buyers would consider a one-stop-shop model for their home-buying journey.” Customers don’t care about core systems and roadmaps. They care about a digital experience that’s fast, easy, and simple. That’s where new competitors are finding their openings.

The development platform to tie today and tomorrow

“Digital transformation” can sound enormous and daunting. Many lenders aren’t fond of the risks of uprooting a successful business and moving to new platforms, even while acknowledging that the market is pushing in that direction. So, shorter-term solutions. Call it “rock and a hard place,” call it “out of the frying pan, into the fire.” Whatever term, it’s an uncomfortable spot.

The ideal solution is a development platform that allows lenders to start with a bite-sized chunk that can realize immediate ROI, then scale and build from there without compromising the business. Short-term goals meet long-term innovation.

That’s where Mendix comes in.

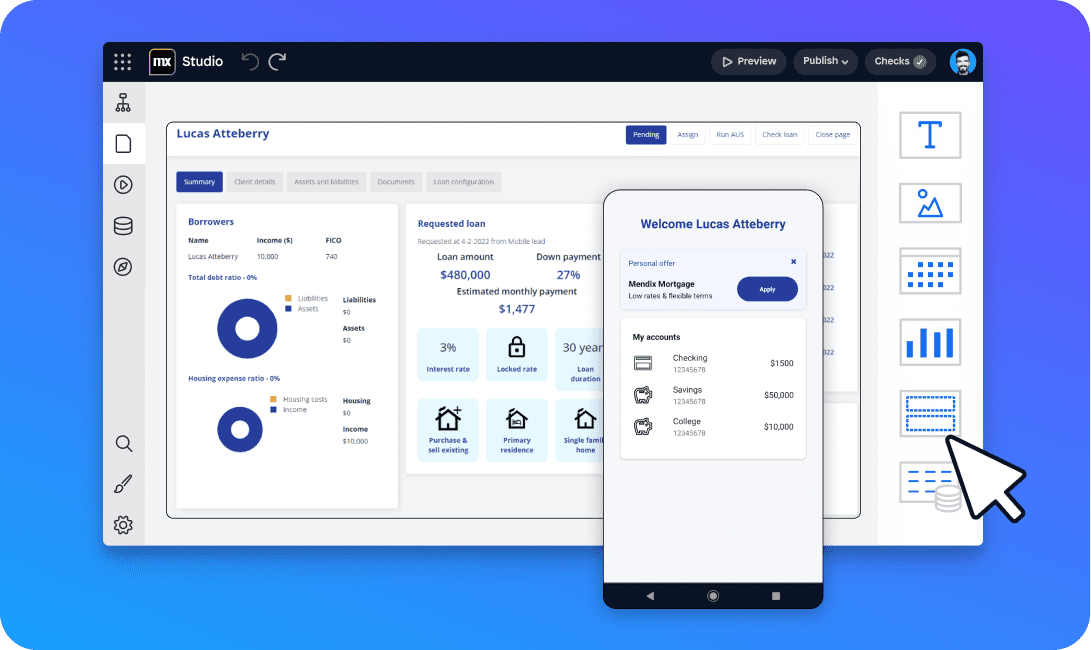

At the highest level, the Mendix platform enables organizations to deploy best-in-class solutions across multiple customer channels at speeds traditional development can’t match. In other words, maximize ROI by getting a better digital CX to market faster.

Mendix Integrates seamlessly with core systems to support business and regulatory requirements and deploys in the way the business demands to ensure security.

What does it all mean? Keep existing core systems intact and create a new layer across them. Simplify and enhance user experience, aggregate data, and make everything run better.

Mendix has a history of helping leaders in the mortgage industry revamp their digital offerings. Augmenting existing technology, home renovation, loan offerings, post-QC processes, and that’s just the start. All possible and all proven.

In just seven months, Collin Crowdfund used Mendix to build an entirely new end-to-end platform. The Mendix platform makes it easier to continue to build, evolve, and iterate.

Transformation in small steps

Quick deployments make it easy to focus on small changes. As a hypothetical, perhaps start with a portal designed to get away from paper and spreadsheets. With that first solution live, pull data from internal and third-party systems out of silos. From there, it’s much easier to see paths to improved, data-driven customer experiences. All that comes from that first small step.

And because every component can be ported and moved to future projects, future deployments are faster and faster.

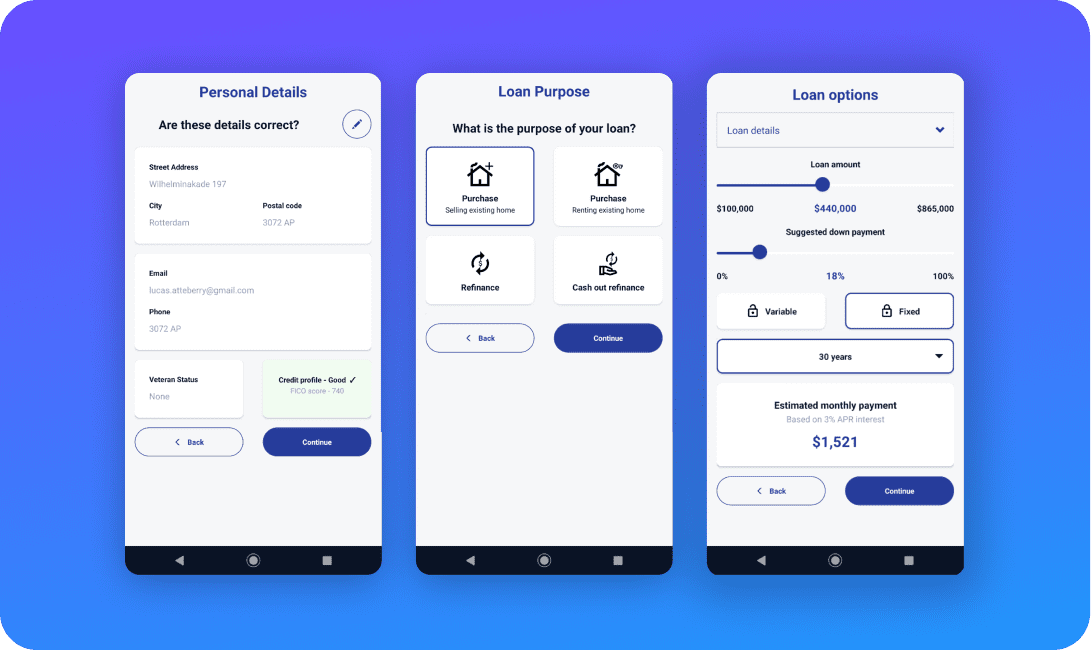

To make that first step even more manageable, Mendix provides optional pre-built templates. The Mortgage Origination solution template consists of several reusable components, like a native mobile app, chatbot, and offer management system.

The template is as customizable as an organization needs and meant to deploy quickly. Those pieces can fuel the following solution, the next, and the next.

That in-app offer you created for mortgage origination can be quickly reused to support your other secured and unsecured business lines. Business and IT collaborate to iterate and deploy quickly, meaning that users save resources and capital with each new solution.

<See how Quion, one of the largest third-party mortgage and consumer credit servicers in the Netherlands, built an online portal for over 260,000 on the Mendix platform.>

Short-term wins to long-term winning

Digital transformation doesn’t have to be a grand vision. It can be a reality. Fast.

Whether you’re using financial services-specific templates or starting from a blank page, the Mendix platform makes it easy to start and get to market. A new blog series focuses on this exact journey and shows how a single solution can help fuel a new digital ecosystem.

Like anything else, seeing is believing. Check out the Digital Lending Transformation Playbook and start with a single step (like the Mortgage Origination template). A quick win fuels future success and enables an org to explore the art of the possible. Mendix enables lenders to create the balance that will lead the market.