The Forrester report, The Future of Insurance, shows that insurance is in a period of previously unheard-of disruption. The app development framework and process insurers have tended to follow in recent history are no longer the best path forward. “You need to become a more customer-focused, collaborative, and faster organization. These digital trends mean new processes, governance models, and metrics,” reads the report. New processes and new models equal new ways of thinking and trends across the digital insurance ecosystem.

So just what does that mean for your organization? Let’s turn again to the experts at Forrester: “The moving parts of the insurance supply chain, from distribution to the connective technology, get disrupted by myriad unpredictable events. The core precepts of agile and design thinking incorporate both speed, flexibility, and resilience into strategic roadmaps.”

Agile development emphasizes collaboration, getting working software out the door, and roadmapping with flexibility. Mendix was founded on Agile design principles, helping businesses increase speed to market while decreasing development time and spend. Developing with Mendix using an agile mindset will help your organization to stand out in the digital future.

[For a more comprehensive introduction to Agile development, take a look at Agile Frameworks]

Learning to pivot

For a lot of insurers, their digital ecosystem is built on layers of vertical integration. Core systems underpin all critical activities with different pieces, workarounds, and shadow IT bolted on over time. That framework has been tried and true for a long time, but it hinders an organization’s ability to pivot.

In a lot of cases, application development roadmaps reflect that lack of agility. Resources are funneled to maintenance and putting out fires in legacy systems while the business gets farther and farther away from actual change that reflects today’s customer needs. Things like process automation and improved customer experience sound great but are difficult to achieve.

Forrester reports that “digitally empowered customers are seeking better, personalized experiences, but product-oriented strategies handicap most insurers.” Today, when organizations that focus on customers are winning, the agility to quickly pivot your strategy isn’t just nice to have. It’s essential.

Agile development with Mendix provides a path to a more flexible roadmap that reflects the needs of the business, IT, and your customers all at the same time. Sounds nice, right?

Now and future solutions with agile thinking

If you’re wondering if Mendix has been able to help insurance organizations make this transition, the answer is a resounding “yes.” Mendix has helped many insurance organizations across the globe to embrace Agile development and revitalize and automate their digital experiences. For example, consider this case study from MS Amlin.

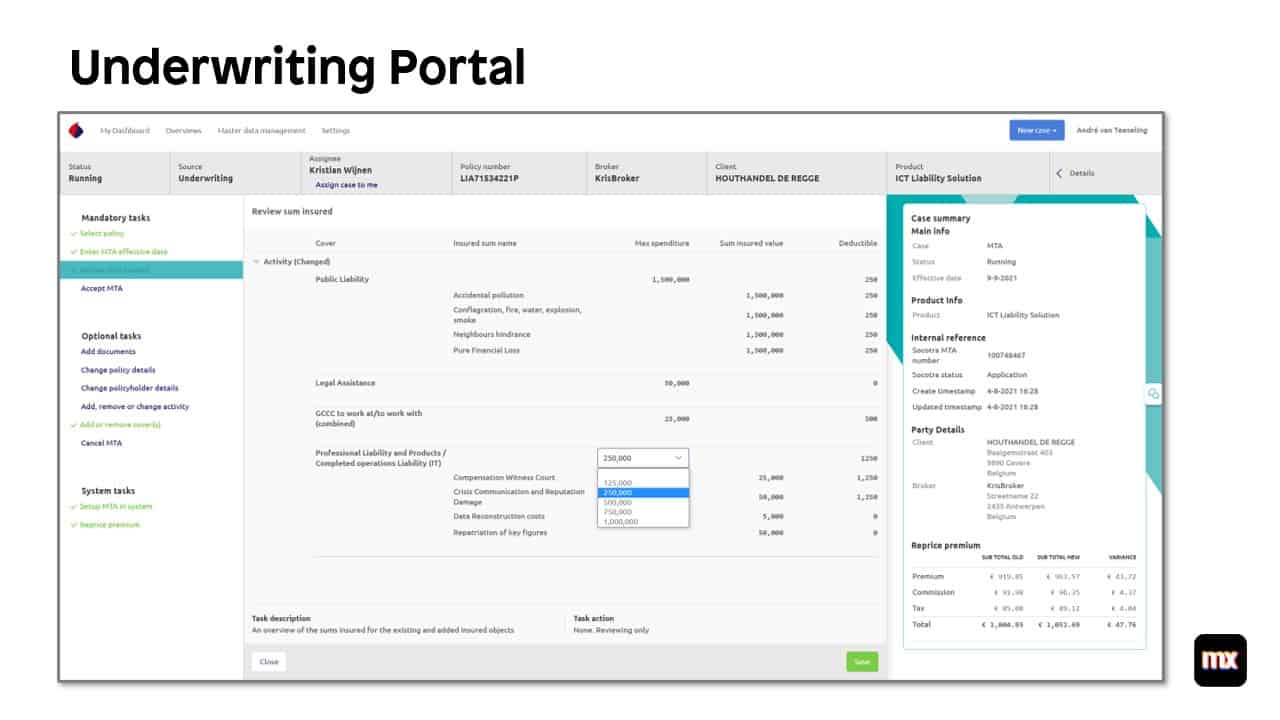

As part of a top-10 global insurer, MS Amlin has the benefit of size and scope. However, they recognized that improving their digital customer experience and process automation was critical to their future. Rather than revamp their whole ecosystem, they partnered with Mendix to start a new automated claims management and underwriting platform. They used Agile frameworks to test, prototype, and release their end-to-end platform in less than a year. The result was a much-improved customer experience that set them up nicely for future contingencies. On top of that, their early successes have encouraged them to continue to move legacy systems onto Mendix solutions.

[See how MS Amlin leveraged Mendix to add speed and automation to their processes while also improving their digital online and mobile experiences. Watch the 2021 Mendix World session: Digitalizing underwriting and claims management with MS Amlin]

The Mendix platform allows for connections to your systems, customizability, and quick deployment. Agile development gives more opportunities to show progress off to key stakeholders, leading to management buy-in and commitment. It’s very much a stone of momentum rolling downhill.

Think of Forrester analysts pointing to flexible roadmaps and agile processes as keys to innovating and the future of insurance, and you can start to see where Mendix can be a differentiating partner for your business.

From vision to visible

You’re bought in and ready for Agile. Now what? For an organization that’s never tried Agile development, it can feel a little bit different. The good news is that you’re probably already doing some of the critical steps.

It all starts with a vision. As the report states, “Digital executives need a vision that moves their firms from experimentation to delivering business outcomes.” Rather than vision as the be-all, end-all, though, it’s the starting point for a more comprehensive conversation.

From there, business and IT stakeholders come together to break vision down to actual deployments. Rather than focusing on the end goal, what are the 1 or 2 projects that can be a good starting point?

As an example, let’s look at some advice from Forrester: “Insurance policies will eventually mold themselves around a customer, becoming living contracts with contextual advice and add-ons to reflect customers’ changing risk conditions.”

That sounds like a massive task with a lot of pieces. Many organizations have aimed for similarly lofty goals, not seen immediate success, and then moved to another short-term objective.

Instead of starting with the big picture, insurers can start with something relatively smaller that points to that bigger goal. Is it adding automation to the claims process? Bringing augmented reality to underwriting? It can be any step, as long as it’s a step you’re committing to and something you can plan to deploy as soon as possible. The Mendix Marketplace offers several solution templates for the insurance industry designed to help you get going.

And what do you do if your first sprint doesn’t turn out a release? If your first foray into Agile with Mendix doesn’t produce spectacular results (although it very likely will), take a deep breath and maybe a walk. Then, move on to the next sprint.

Learning to innovate is as vital for success as the innovation itself. Organizations that have succeeded in implementing Mendix solutions and Agile methodology have started on smaller-scale projects that can be developed, tested, and released quickly. They don’t have to be perfect so long as they’re functional.

Take the wins, the failures, and the learning points and continue to iterate. Develop quickly, release with updates in mind and celebrate success. Those are the keys to Agile.

Act, don’t react

When you’re thinking about the best digital path forward for your organization, it’s easy to be overwhelmed. With so many customers demanding more and more from their insurers, it’s clear that significant change isn’t just coming. It’s already here. But by reading this Forrester report and learning about Agile, you’re already taking an enormous step.

Forrester tells us that “digital insurance leaders should identify the most important ecosystems for their customers.” Committing to that ecosystem and Agile development with Mendix will put you in the position to be the best in the market, rather than scrambling to react to competitors. Insurers that embrace agile thinking with Mendix will delight and win customers now and in the future. Those that don’t risk being left in the past.

All quotes from “The Future of Insurance,” Forrester Research, Inc., 18 March 2021