MX Blog

Highlighted Article

Explore topics

All Articles

-

![]() Manufacture Digital Transformation with Low-Code

Manufacture Digital Transformation with Low-Code -

![]() Why It’s Important to Keep Your SAP Core Clean

Why It’s Important to Keep Your SAP Core Clean -

![Unlock the Gen AI Magic How to Tailor Foundation Models with Custom Data]() Unlock GenAI Magic: How to Tailor Foundation Models with Custom Data

Unlock GenAI Magic: How to Tailor Foundation Models with Custom Data -

![Agile Development Lifecycle]() The 5 Stages of the Agile Software Development Lifecycle

The 5 Stages of the Agile Software Development Lifecycle -

![cloud native app development]() Cloud-Native Apps: Examples, Benefits, and More

Cloud-Native Apps: Examples, Benefits, and More -

![Mendix - using Internal PR to accelerate digital transformation]() The Role of Internal PR in Digital Transformation

The Role of Internal PR in Digital Transformation -

![mendix logo background]() How to Choose the Right Enterprise Development Platform

How to Choose the Right Enterprise Development Platform -

![]() 3 Reasons You Need to Rethink Low-Code Governance

3 Reasons You Need to Rethink Low-Code Governance -

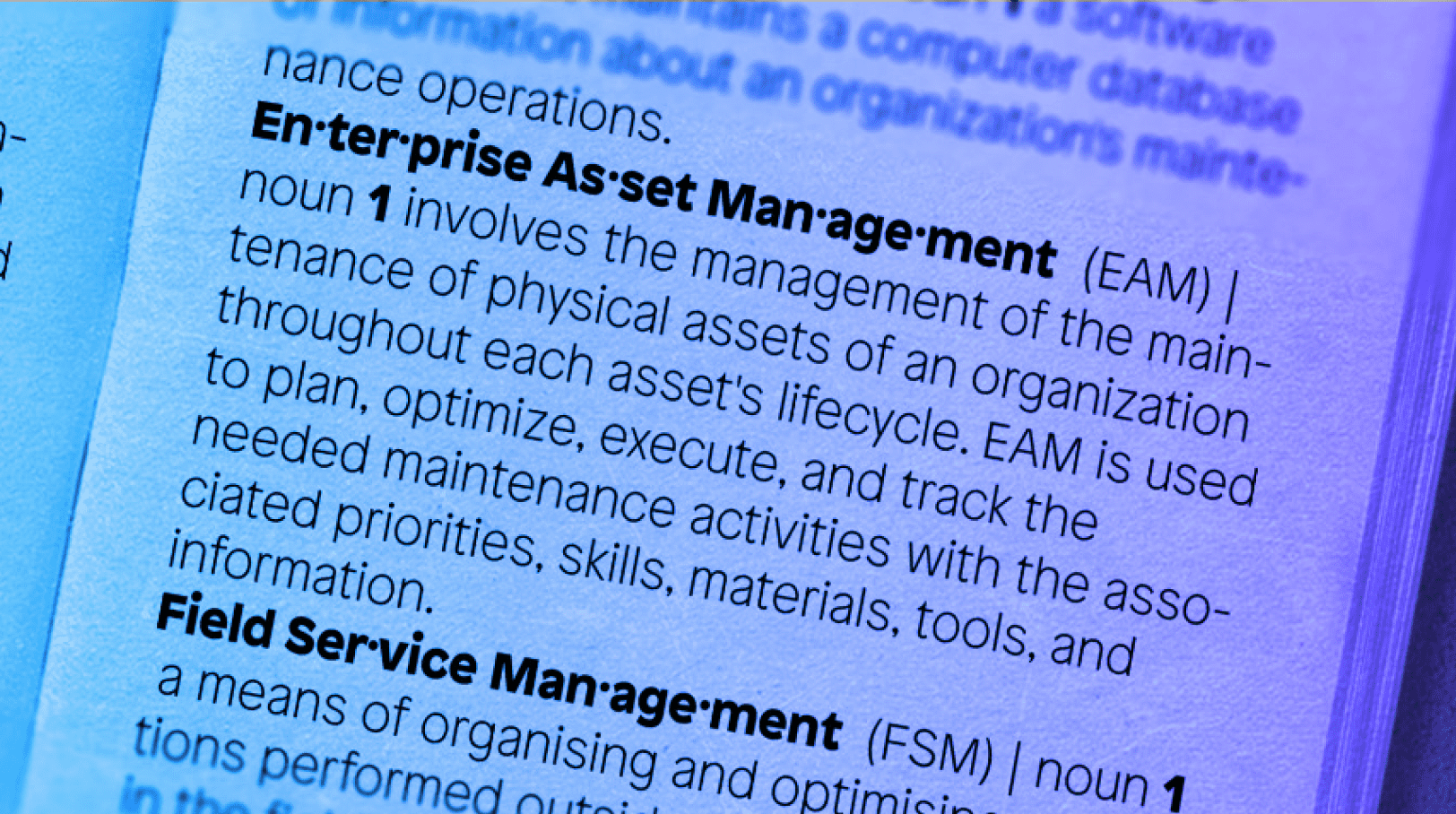

![]() CMMS, EAM, FSM, ERP: What's in a Name?

CMMS, EAM, FSM, ERP: What's in a Name? -

![4 Ways Blog Header Image]() 4 Ways Mendix Is Advancing Manufacturing

4 Ways Mendix Is Advancing Manufacturing -

![]() Mendix Release 10.9 – See What’s Inside!

Mendix Release 10.9 – See What’s Inside! -

![]() Building Your Own REST API-based AWS Connector

Building Your Own REST API-based AWS Connector